The U.S. data center market could exceed $120 billion by 2026. But beneath this trajectory lies infrastructure strain, rapid innovation, and fundamental change. This blog breaks down the key trends shaping U.S. data centers in 2026—and what they mean for the land, power, and people behind them.

Contents

-

The AI Infrastructure Market

-

The Power Bottleneck Continues

-

The Future of Cooling

-

Evolving Fiber Standards

-

Potential Tighter Regulations

-

Low Vacancy Rates Continued

-

Efficiency Through Automation: AI-Driven DCIM and Digital Twins

-

Investing in Education to Mitigate Workforce Shortages

Final Takeaway: Preparing for the 2026 Data Center Landscape

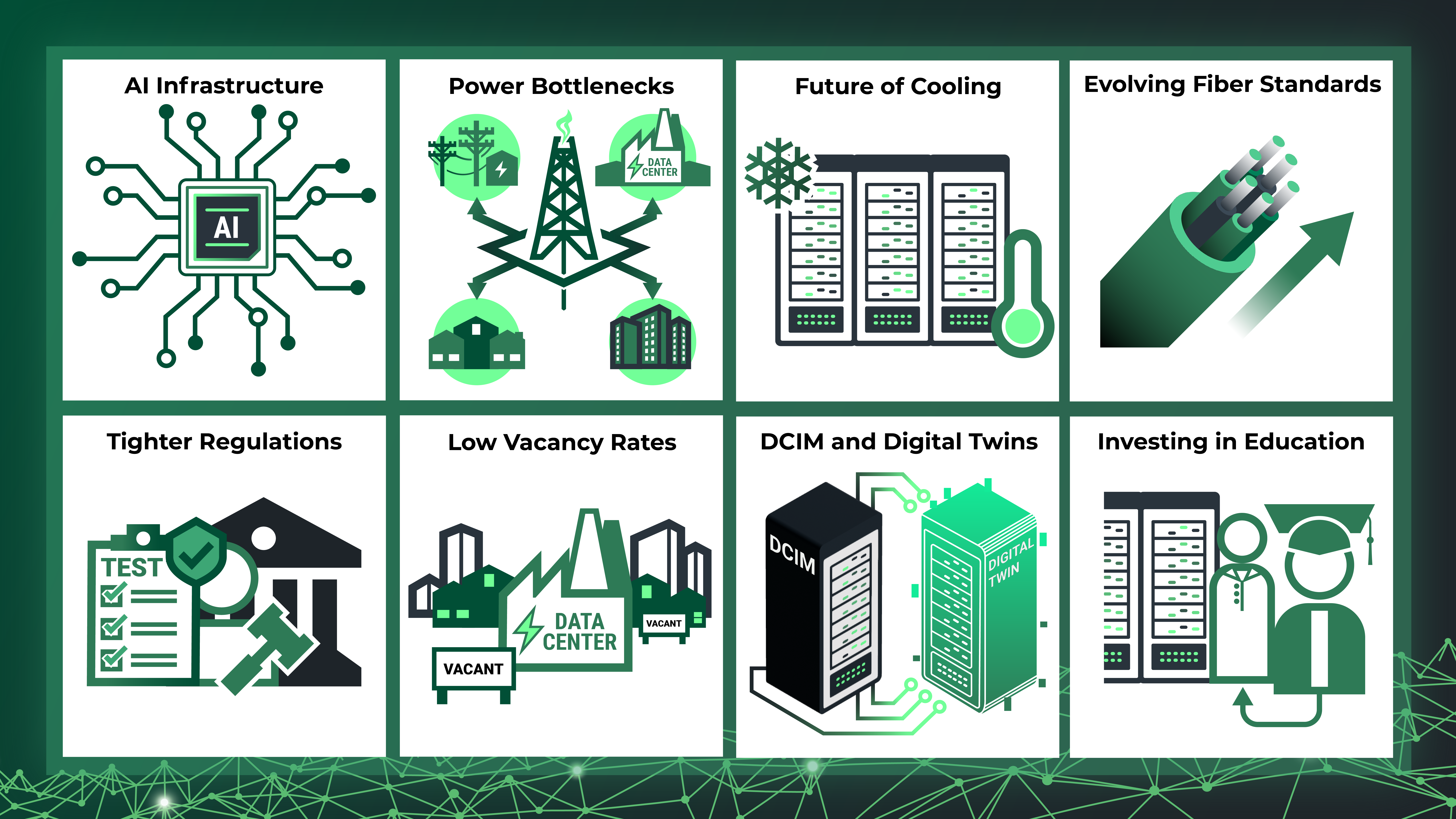

1. The AI Infrastructure Market

AI-centric workloads are driving data center design, spending, and location decisions. Hyperscalers appear to be positioning for massive investments to build GPU-optimized cloud infrastructure. This is triggering a global rush to secure the three scarcest resources: power, land, and talent.

Key data points:

- The top 5 hyperscalers (Amazon Web Services, Microsoft Azure, Google, Meta, and Oracle) are projected to spend as much as $602 billion in 2026.

- CPU-centric layouts are being displaced by AI-native HPC architectures in modern data centers.

2. The Power Bottleneck Continues

With interconnection delays stretching up to 5-7 years in major markets, developers are adopting new strategies to meet ever-growing demand.

Here’s how they're doing it:

- Microgrids: Developers are siting facilities on gas pipelines to generate on-site power and avoid grid interconnection delays.

- Behind-the-Meter Prime Power: Operators are running natural gas turbines or fuel cells as the main power source, with the grid as backup only.

- Nuclear Co-Location: Some developers are buying land near nuclear plants to tap carbon-free power directly.

- Secondary Market Expansion: Investment is shifting investment to Tier 2 markets like Ohio and Atlanta, where power is available and timelines are shorter.

- Cooling Methods: Operators are installing direct-to-chip cooling to cut energy use and unlock more capacity for compute.

3. The Future of Cooling

By 2026, densities are anticipated to jump from ~20–40 kW (legacy average) to 120–140 kW per rack, making liquid cooling critical. Liquid cooling’s efficiency (3,500x the heat capacity of air) makes it indispensable for AI-heavy deployments.

This density shift forces a real estate transformation: fewer racks, smaller footprints, but radically different cooling and airflow requirements.

4. Evolving Fiber Standards

As LLM training pushes bandwidth to its limits, here’s how fiber is evolving to keep up:

- Hybrid Electrical/Optical Fabrics: Operators are adopting mixed switching architectures (hybrid fabrics) to handle unpredictable, high-throughput workloads.

- Silicon Photonics: Optical circuit switches using silicon photonics now offer near-instant (~10 µs) connection times, reducing bottlenecks at scale.

- Layer-1 Encryption: With AI data increasingly sensitive, encryption is moving directly into the fiber layer to secure data in transit.

5. Potential Tighter Regulations

While the federal government pushes to accelerate AI infrastructure, state and local governments are hitting the brakes. As energy use and local pushback grow, regulations are tightening the rules.

State-by-State Shifts:

- Georgia (Pay-to-Play Power)

New data centers over 100 MW now pay upfront for grid upgrades, ending ratepayer subsidies.

- Illinois (Development Pause)

Aurora issued a 6-month moratorium on new data center approvals to rewrite zoning laws focused on noise, water, and traffic.

- Virginia (Noise Restrictions)

Prince William County’s Noise Ordinance Update aims to enforce stricter decibel limits, forcing operators to rethink cooling systems near residential areas.

Developers may face higher upfront costs, stricter zoning, and mandatory environmental reporting. Community resistance is rising, and new builds are under greater scrutiny than ever, suggesting there could be tighter regulations for 2026 development.

6. Low Vacancy Rates Likely to Continue

According to CBRE’s North America Data Center Trends reports, vacancy rates in primary markets have dropped from 3.3% in 2023 to under 2% in 2025, with pre-leasing activity signaling these conditions will persist through 2026. 80% of capacity currently under construction is pre-leased.

7. Efficiency Through Automation: AI-Driven DCIM and Digital Twins

AI-scale infrastructure can’t be managed manually. To meet new performance and uptime demands of 2026, operators are automating how data centers are monitored and optimized.

- AI-Driven DCIM: Infrastructure management tools will use AI to automate maintenance, forecast failures, and fine-tune power and cooling in real time.

- Digital Twins: Virtual models of physical data centers will let operators simulate changes before they’re made in real-time—maximizing uptime and minimizing risk.

Together, these tools push efficiency to new levels, allowing operators to safely increase utilization and reduce operational overhead.

8. Investing in Education to Mitigate Workforce Shortages

Running high-density, AI-optimized facilities requires a highly specialized workforce, yet supply is tight.

Key skillsets include:

- Power and network engineering.

- Liquid cooling technicians.

- Grid interconnection specialists.

- ESG and carbon reporting compliance officers.

Competition for specialized talent is expected to intensify significantly through 2026. As a result, many data centers have started investing in local communities and education.

- Texas Tech and Fermi America: The site plan includes a dedicated facility space designed to equip the next generation with practical training and workforce skills.

- Amazon: The site introduces specialized education and training initiatives for STEM learning programs.

- Meta: Meta’s Data Center Community Action Grants program supports STEM education in communities where their data centers are located.

Final Takeaway: Preparing for the 2026 Data Center Landscape

AI is compressing decades of transformation into a few short years, fundamentally altering how we build, power, and operate data centers. To thrive, those involved in land, utilities, and planning, must:

- Secure Power – Availability is the ultimate growth constraint.

- Plan for Density – Cooling and power delivery must scale together.

- Design for Compliance – Regulation can shape ROI and compliance can impact cost and design.

- Operate Intelligently – AI-driven systems are non-negotiable.

- Invest in People – Talent will determine scalability, and human talent is just as critical as hardware.

2026 is reshaping site selection.

Get the Acres Data Center Site Selection Playbook and see how to find land that aligns with next-gen infrastructure needs like prime power, liquid cooling potential, and environmental risk.