CoreWeave’s $9 billion acquisition of Core Scientific marks a major step in the race to acquire power-ready sites for AI workloads. This strategic portfolio of ten power-rich data center sites across the U.S. gives CoreWeave control over critical digital infrastructure in a market where feasible sites are vanishing fast.

The Core Deal

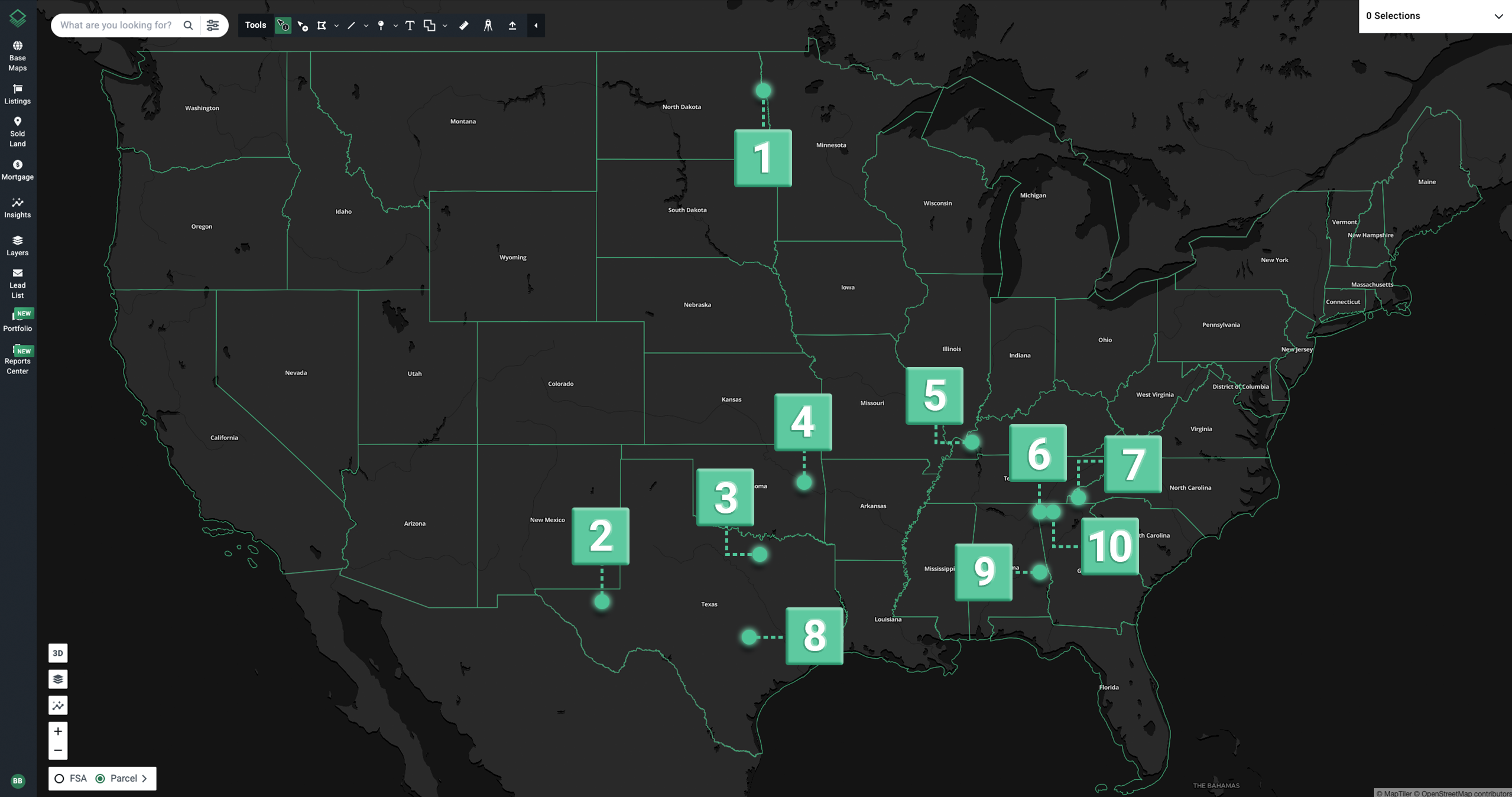

Core Scientific’s portfolio spans ten data center sites across the U.S., all positioned near key power and connectivity infrastructure. This gives CoreWeave a power-ready foundation to rapidly scale AI workloads.

By acquiring these sites, CoreWeave secures direct access to over 1.3 gigawatts of current capacity and a future pipeline exceeding 2.3 GW, reinforcing its ability to meet the growing energy demands of AI.

The Strategic Edge

- Control & Speed: Owning the data centers gives CoreWeave full control over its infrastructure, avoiding lease negotiations and supply constraints. This drastically speeds up their ability to bring AI compute services to market.

- Power is Everything: AI is incredibly energy-intensive, and the U.S. grid is facing enormous challenges as demand quickly outpaces supply. This deal is fundamentally a power grab. CoreWeave secures the infrastructure needed to train and run next-generation AI models.

- Future-Proofing: Acquiring the sites under development ensures a pipeline for future expansion, which is crucial in a market where demand for AI infrastructure is exploding.

The Site Portfolio

1. North Dakota – Grand Forks (Grand Forks 1)

- 100 MW capacity

- Between key connectivity hubs (Minneapolis, Fargo, Winnipeg)

- Adjacent to transmission lines and multiple substations

2. Texas – Pecos (Cottonwood 1 and 2)

- 250 MW capacity

- Low-cost, low-disaster risk location

- Multiple substations within 10 miles

3. Texas – Denton (Denton 1)

- 391 MW capacity

- Power-dense parcel near fast-growing Dallas data center market

- 2 transmission lines, 2 gas lines, and 3 substations on-site

4. Oklahoma – Muskogee (Muskogee 1)

- 100 MW now, scalable past 500 MW

- Transmission and 3 substations adjacent

5. Kentucky – Calvert City (Calvert 1, 2, and 3)

- 150 MW capacity

- Transmission line and substation on parcel

6. Georgia – Dalton (Dalton 1 and 2)

- 50 MW capacity

- Between Chattanooga, Nashville, and Atlanta markets

- Multiple substations, transmission and gas lines

7. North Carolina – Marble (Marble 1)

- 103 MW capacity

- 2 transmission lines and 1 on-site substation (with more nearby)

- Fiber connectivity to Knoxville, Charlotte, Nashville, and Atlanta

8. Texas – Austin (Austin 1)

- 20 MW capacity

- In a fiber-rich, high-growth hub

- 2 gas lines, 2 transmission lines, and nearby substations

9. Alabama – Auburn (Auburn 1)

- 16 MW capacity

- First NVIDIA-certified site in the state

- Transmission line runs through site

10. Georgia – Dalton (Dalton 3)

- 142 MW capacity

- North of the Atlanta major metro area

- Close proximity to substations, transmission and gas lines

Final Thoughts

CoreWeave’s acquisition of Core Scientific isn’t just about data centers. It’s about speed, energy, and the ability to build at scale. This portfolio gives them an edge where power-ready land is scarce.

Subscribe to Acres Intel’s Data Center Edition on LinkedIn for strategic insights on where AI infrastructure is heading, how grid dynamics are reshaping site selection, and what it takes to compete in the race for power-ready land.