Last year, we mapped out the emerging data center markets to watch in 2025. Since then, primary markets have grown more constrained, hyperscale investment has accelerated, and a new class of power-rich, land-abundant markets has moved from “ones to watch” to active construction zones. Here’s where things stand heading into 2026.

Contents

Key Drivers Shaping the 2026 Data Center Landscape

Established Primary Markets

Emerging U.S. Data Center Hotspots for 2026

Key Drivers Shaping the 2026 Data Center Landscape

The same fundamentals that drove 2025—AI demand, power constraints, land scarcity —haven’t gone away. They’ve intensified. A few forces in particular are defining where and how data centers get built this year.

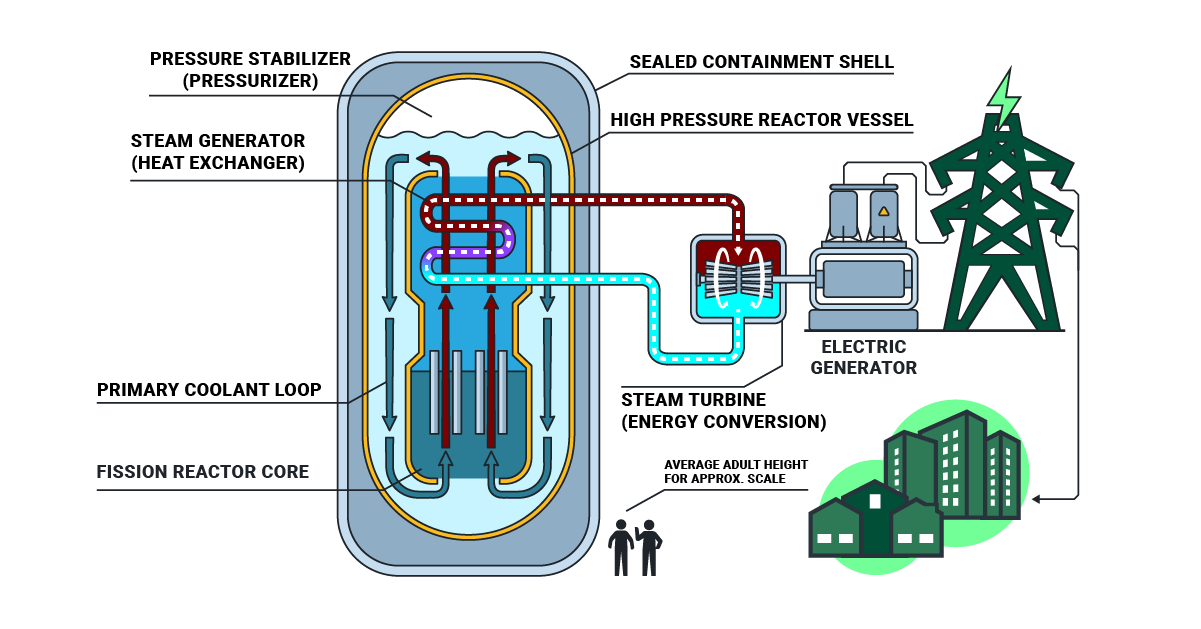

Nuclear Energy

Investment in nuclear generation and next-gen Small Modular Reactors (SMRs) is accelerating. Microsoft’s 20-year power purchase agreement to bring Three Mile Island back online, Meta’s nuclear energy portfolio, and Google’s investment in Kairos Power SMRs are clear indicators of where hyperscale energy strategy is headed. That momentum is expected to intensify in 2026 as operators continue to seek carbon-free capacity to support AI-driven load growth.

Incentives

States are still competing for data center investment through tax exemptions and infrastructure support. However, the regulatory landscape is becoming less predictable. Many states are revisiting or rolling back exemptions, and local communities dealing with noise, water use, and grid strain are increasingly pushing back.

Power Proximity

Fiber proximity used to anchor site selection. In 2026, the deciding factor is speed to power. In heavily constrained markets like Northern Virginia, large-load interconnection timelines can stretch up to seven years, pushing developers far outside traditional corridors and toward Behind-the-Meter (BTM) generation. Increasingly, the question isn’t whether a market has demand, it’s whether it can deliver power on a timeline that matches hyperscale deployment cycles.

Megacampus Scaling

Generative AI has fundamentally changed what data center development requires. Rack densities are now routinely exceeding 100-120 kW. These “AI factory” facilities require liquid cooling, massive power infrastructure, and large, scalable footprints. As a result, hyperscalers are increasingly prioritizing megacampus-style sites that can deliver power quickly and expand as needed.

Diagram illustrates a baseline SMR design; 2026 deployment trends are increasingly shifting toward advanced, next-generation reactor architectures.

Established Primary Markets

The major hubs aren’t going anywhere, but they’re bumping up against some limits. Understanding where the constraints are helps explain where new investment is flowing.

- Northern Virginia: Remains the world’s largest market, but severe grid congestion and multi-year utility queues have slowed new large-scale projects, pushing development into surrounding counties and states.

- Dallas-Fort Worth, TX: Continues to attract massive hyperscale investment as the nation's second-largest market, fueled by affordable power costs and a central location ideal for national distribution.

- Phoenix, AZ: Following a 2022–2024 development surge, developers are now navigating high utility backlogs and intensifying power grid limitations.

- Silicon Valley, CA: Remains a critical tech industry hub, though extreme land costs grid challenges are making large-scale new builds difficult.

- Chicago, IL: Continues to attract hyperscale and AI investment by leveraging state tax incentives, a dense fiber legacy, and a central geography that offers regional latency.

Emerging U.S. Data Center Hotspots for 2026

These markets are attracting investment not because they’re secondary options, but because they offer something primary markets can’t: room to build, power to scale, and favorable regulatory environments.

Texas: Abilene, Houston & Beyond

Texas’ deregulated ERCOT grid, abundant land, and “bring your own power” policies—which allow on-site generation outside traditional interconnection queues—position the state for large-scale AI investment.

With DFW already in position as the second largest data center market in North America, expansion is moving outward. OpenAI and Oracle’s Stargate site in Abilene and Texas Tech and Fermi America’s HyperGrid campus near Amarillo signal that hyperscale development is no longer concentrated in Tier 1 metros. Austin, San Antonio, and Houston are also seeing increased activity as operators secure power and land in counties that weren’t on the radar a few years ago.

Indiana and Ohio

Northern Indiana has become a high-density compute corridor. In St. Joseph County, AWS is scaling development rapidly, with more than a dozen buildings under construction to support next-gen AI training. Nearby, Hobart is following suit as primary markets strain under power constraints.

In Ohio, Cologix’s 800 MW campus in Johnstown and expanded investment in New Albany reflect a move toward self-sufficient tech hubs where data centers, chip manufacturing, and dedicated power plants are built together. This 'all-in-one' approach gives Ohio a rare edge in energy stability and supply chain speed.

Port Washington, Wisconsin

Wisconsin has entered the "megacampus" era with the $15 billion “Lighthouse” campus in Port Washington. This collaboration between Vantage, Oracle, and OpenAI is one of the most ambitious AI builds in the Midwest.

The state offers what saturated Midwest markets are running short on: available land, utility capacity, and a favorable regulatory posture for large industrial investment.

Louisiana and Mississippi

The Deep South is capturing some of the most ambitious project announcements. In Louisiana, Meta and Blue Owl Capital’s “Hyperion” campus in Monroe is a $27 billion development designed to scale to 5 GW across 2,250 acres.

Mississippi is emerging alongside it with the Compass “Meridian” campus in Lauderdale County and xAI has established data center operations in Southaven, adding more AI cloud presence to the state’s growing portfolio.

Final Thoughts

The shift underway in 2026 shows that primary markets will remain important, but the real story is in places like Abilene, Monroe, New Albany, and Port Washington: markets that can offer what developers actually need right now. For data center operators, investors, and developers, the opportunity is in identifying these sites before the rest of the market catches up.

Staying ahead means knowing where the next move is happening—before it happens. Contact our sales team today to learn more about the Acres Data Center Index.

-4.png)