Do you have full visibility into your land pipeline today? Do you know what builders are acquiring land nearby?

These are high stakes questions for builders and land acquisition teams, but all too often, land development decisions rely on incomplete or outdated information.

And land data is inherently messy. Ownership records can be hidden behind LLCs, public filings are delayed, and competitor activity isn’t visible until it’s too late. This leaves builders making big bets without the full picture.

The result? Competitors buy nearby land unnoticed. Submarkets become crowded before project launch. Assumptions are skewed by inaccurate or delayed public data. And for builders waiting out unfavorable conditions, carrying costs rise.

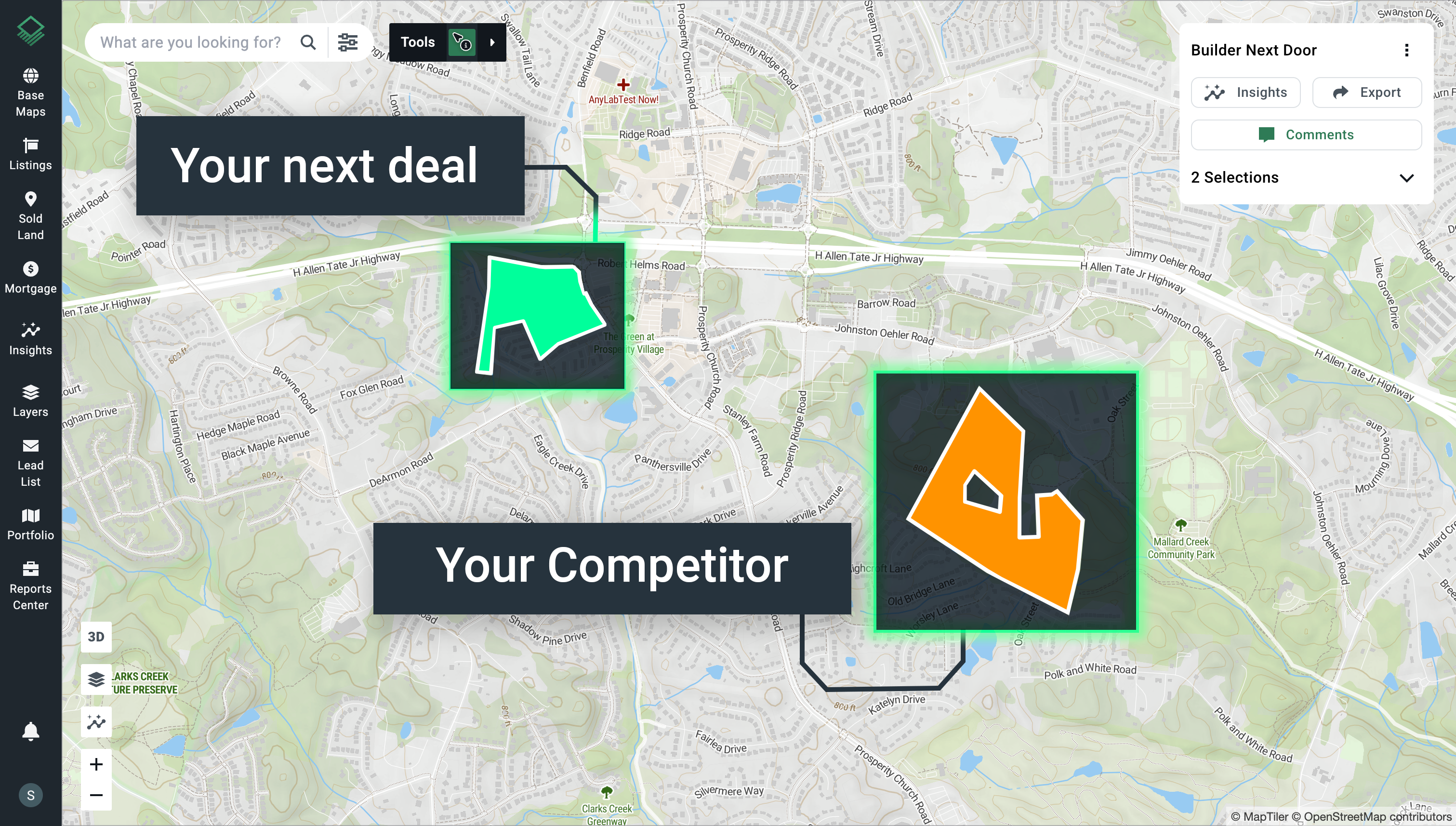

Case Study: The Builder Next Door

What happens when you don’t have full visibility into a market? Here’s one scenario where that blind spot became costly:

A regional builder purchased a 25-acre parcel, underwriting for $475K homes. Within three months, a competitor launched nearly identical homes just down the road—priced $50K lower.

As a result, the builder’s assumptions unraveled overnight. They were forced to choose between slashing prices or holding land longer with mounting costs.

The problem wasn’t demand. It was a lack of visibility into competitor land strategies. This blind spot could have been avoided with complete, real-time market intelligence.

How Builders Can Protect Their Land Acquisition Pipeline

- Don’t rely on lagging signals: By the time public data catches up, competitors may already control the best parcels.

- See through complexity: Builder activity is often hidden behind LLCs and shell companies, creating blind spots for acquisition teams.

- Get the full picture: Fragmented intel and spreadsheets leave gaps. Success depends on a complete and connected view of the market.

The Future of Land Acquisition Intelligence

Builders who want to stay ahead must adopt a new standard: real-time visibility into market activity, competitor strategies, and growth corridors.

This is what the Acres Home Builder Index is built to deliver. By giving acquisition teams an early, connected view of the market, the Index helps builders:

- Spot competitor land activity early.

- Avoid oversaturated markets.

- Protect margins by making informed acquisition decisions.

FAQs: Land Acquisition and Builder Strategy

Q: Why is land acquisition data so fragmented?

A: Ownership is often hidden through LLCs, filings are delayed, and every jurisdiction uses different systems. The result is a tangled mess of spreadsheets, websites, and software that slow down workflows and increase risk.

Q: How can home builders reduce risk in land deals?

A: Use a complete land intelligence platform (like Acres!) that combines real-time market intelligence and competitor tracking, tools for site selection, and collaborative portfolio features. This keeps your team on the same page, provides enhanced portfolio visibility, and gives you a competitive advantage.

Q: What is the Acres Home Builder Index?

A: The Acres Home Builder Index is a proprietary dataset built for professionals navigating the complex and competitive landscape of today’s residential real estate market. Purpose-built for today’s home building landscape, the Index combines Acres’ unmatched land acquisition tracking with advanced site suitability intelligence—offering unprecedented visibility into where builders are buying, developing, and expanding across the country.

Connect with our team to learn more about the Acres Home Builder Index and how you can get years ahead of the market.