The Acres Home Builder Index uses proprietary land acquisition tracking to provide this future-state intel into where the market is headed.

Here’s what the Index reveals in the greater Raleigh-Durham market in North Carolina:

- Total acres: Top builders have acquired more than 7,000 acres in the Raleigh area over the past five years alone.

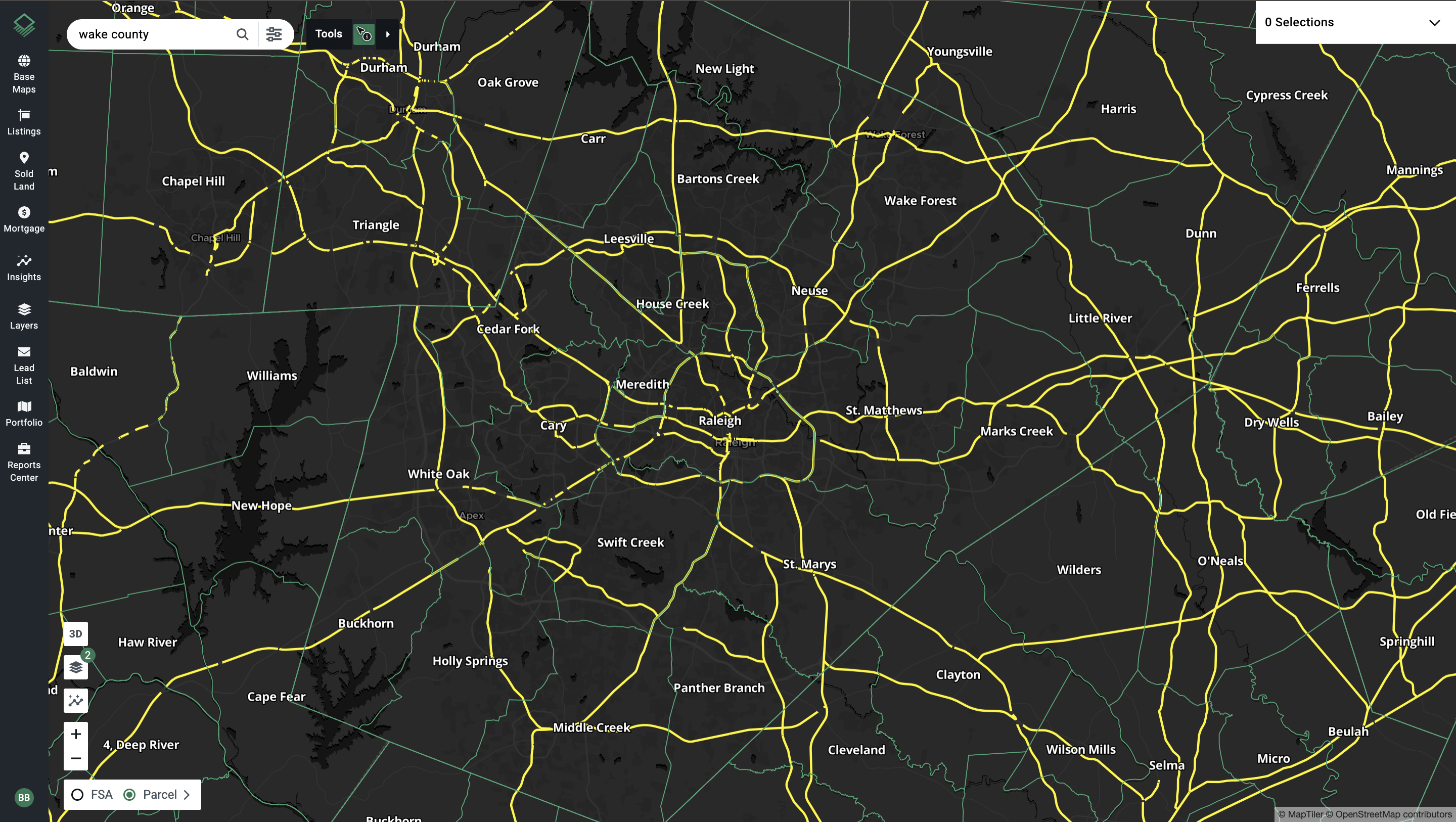

- New growth corridors: Lennar, Clayton, and PulteGroup are expanding into rural and suburban areas like Carr, Oak Grove (Durham), Wake Forest, Marks Creek, and Middle Creek (Raleigh).

- Attractive prices: Despite rising prices, developers are staying active thanks to comparatively attractive land values across the metro.

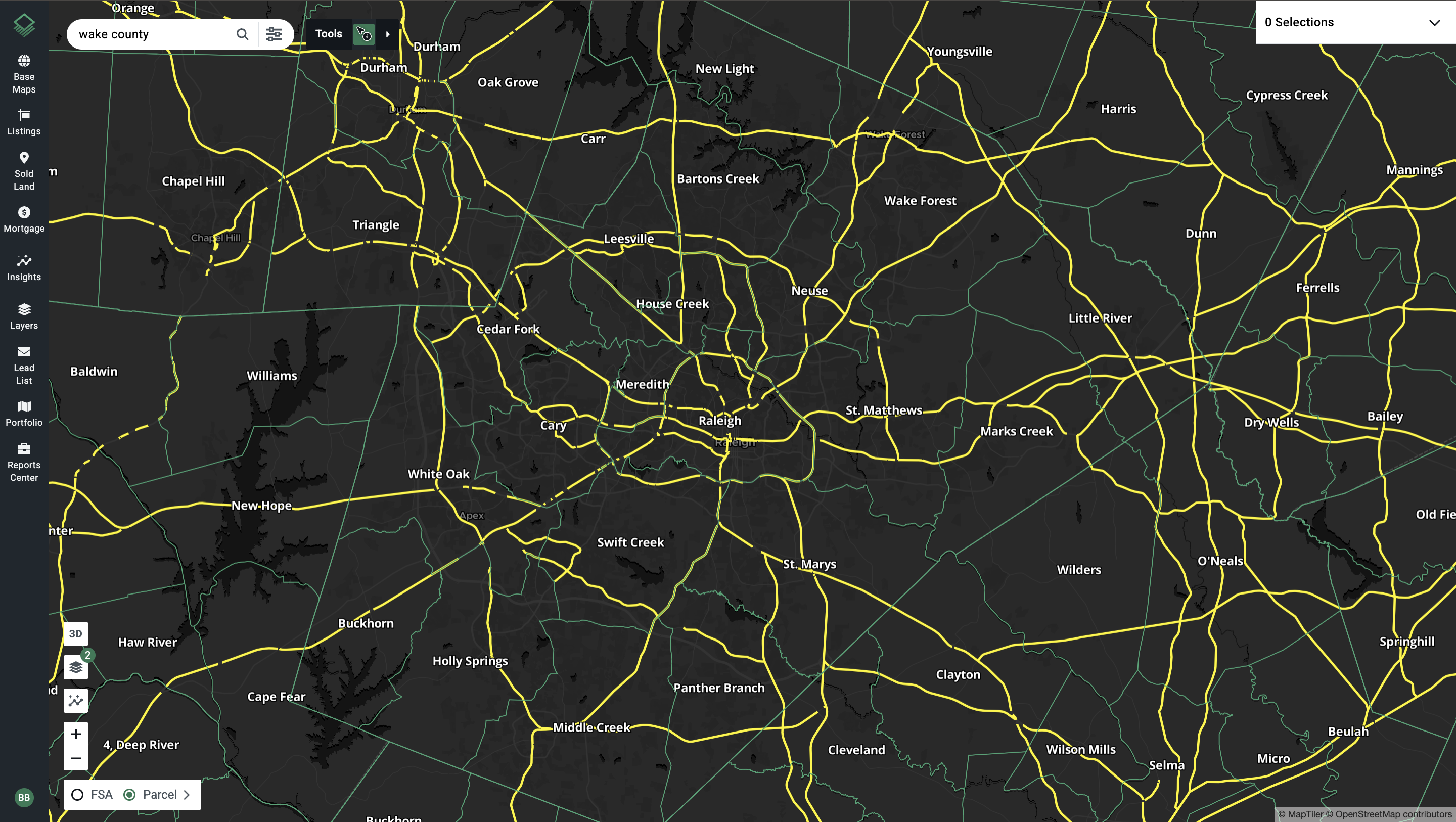

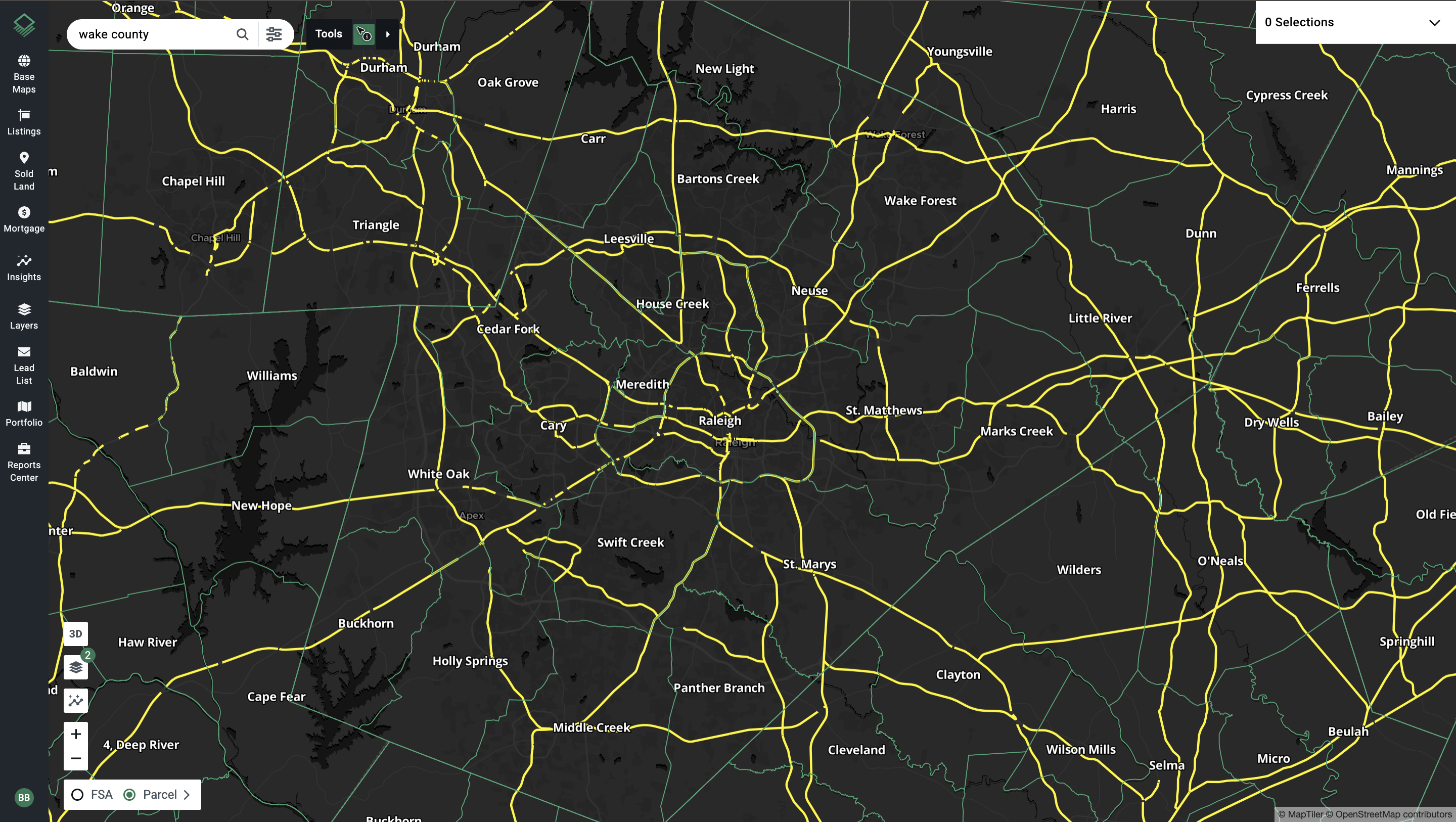

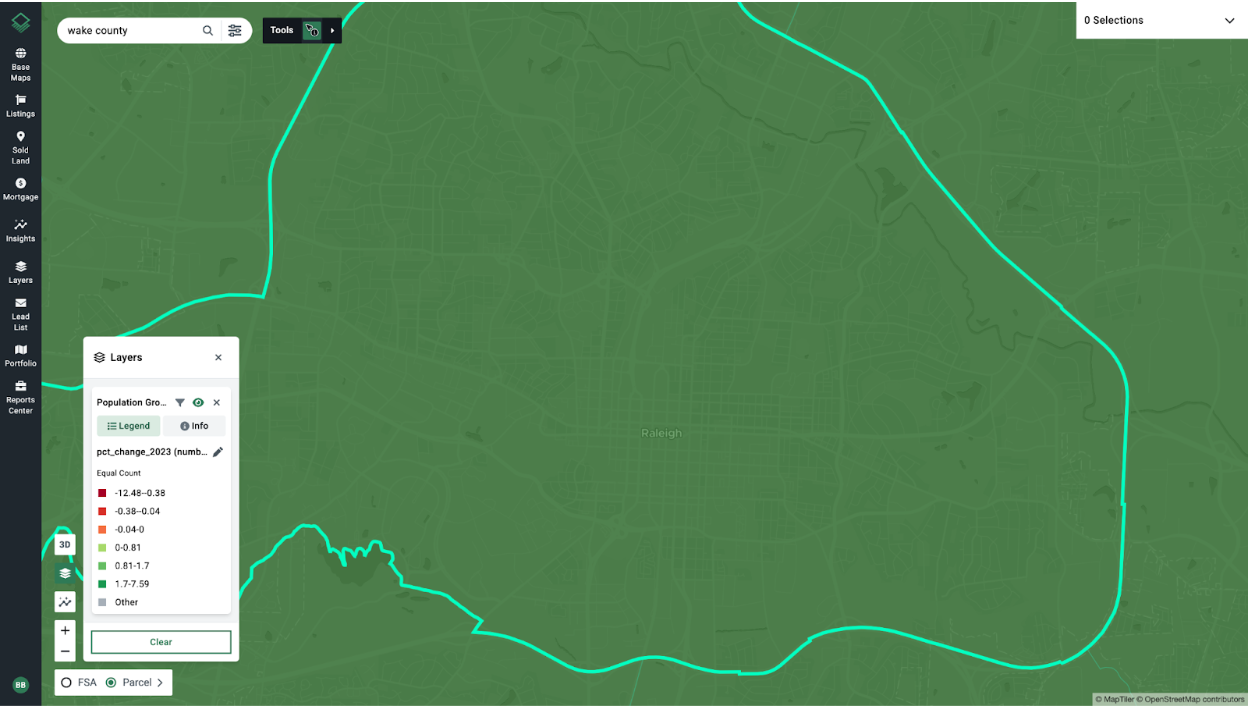

Visualizing Builder Activity in Raleigh

The following charts bring the Raleigh housing market data from the Acres Home Builder Index to life:

Race graph represents Raleigh’s top 10 builders by acres acquired, 2020-2025 (left). Map represents builder land acquisitions across Raleigh and surrounding counties over time, 2019-2025 (right).

What’s Attracting Home Builders to Raleigh?

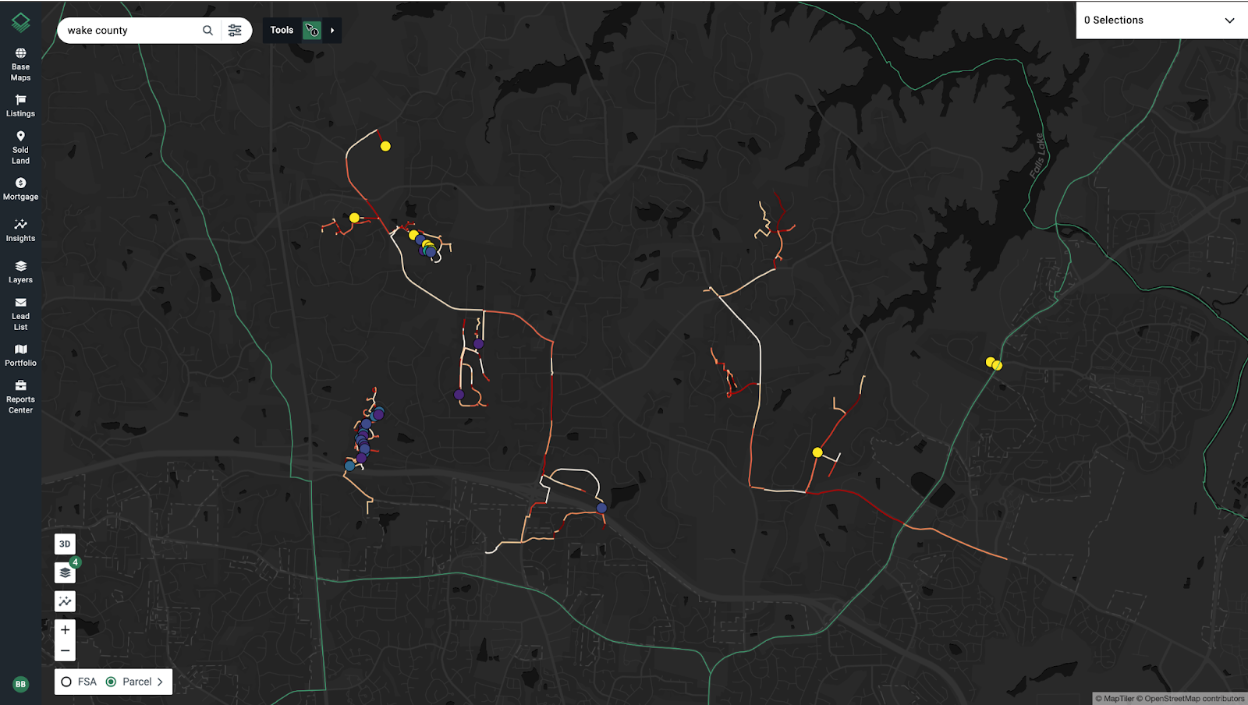

Using the Acres Home Builder Index and Acres’ Layers, you can visualize builder trends and uncover what’s driving their land acquisition decisions. Here’s what’s attracting them to the Raleigh area:

Highway Expansion: Major projects like the I-540 loop and enhancements to NC 42 and US 64 are unlocking access to previously undeveloped areas. Builders are targeting land near these corridors to meet future commuter demand and capitalize on improving connectivity.

With Acres’ highway planning layers, teams can predict where development will radiate outward as population density increases and identify acquisition targets that align with long-term growth patterns.

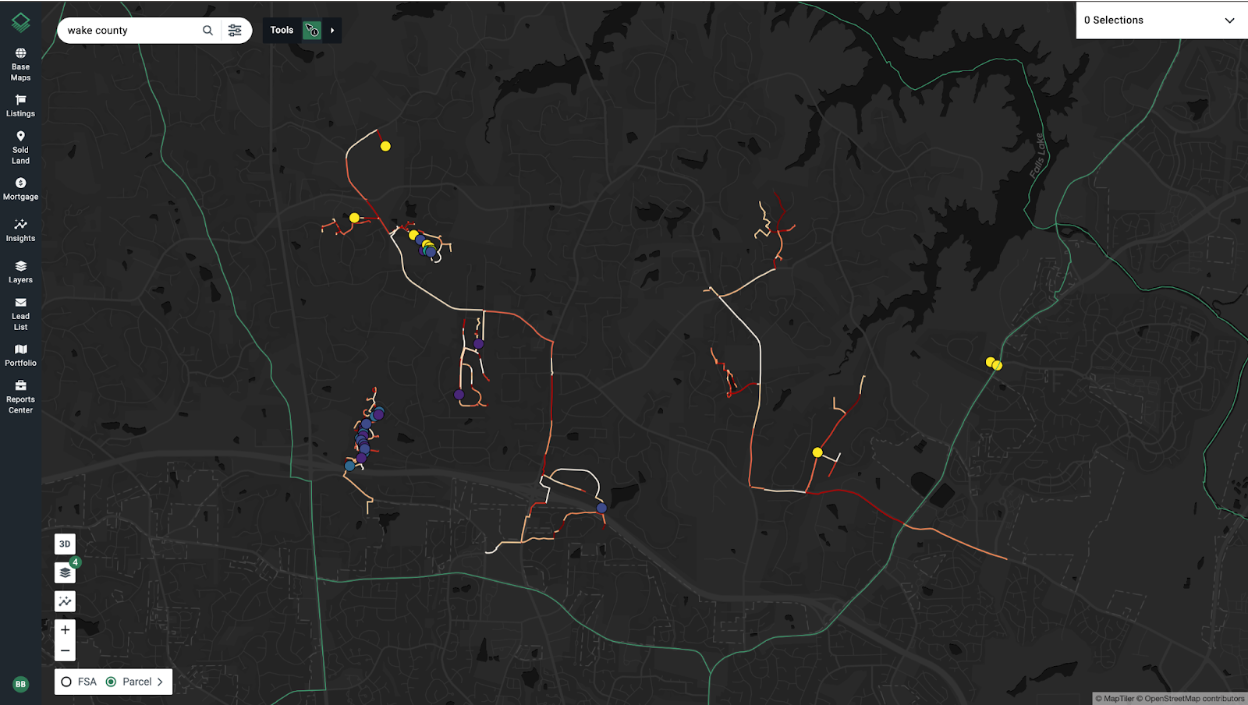

Utility Infrastructure Mapping: Access to water and sewer mains significantly impacts land acquisition timelines and costs. The extension of water and sewer services into suburban and rural fringe areas like Johnston and Franklin Counties is opening up new regions for development. Builders are prioritizing these zones to avoid delays and cost overruns tied to utility installation.

Acres’ utility layers map existing water and sewer lines, helping builders evaluate infrastructure access and streamline site selection.

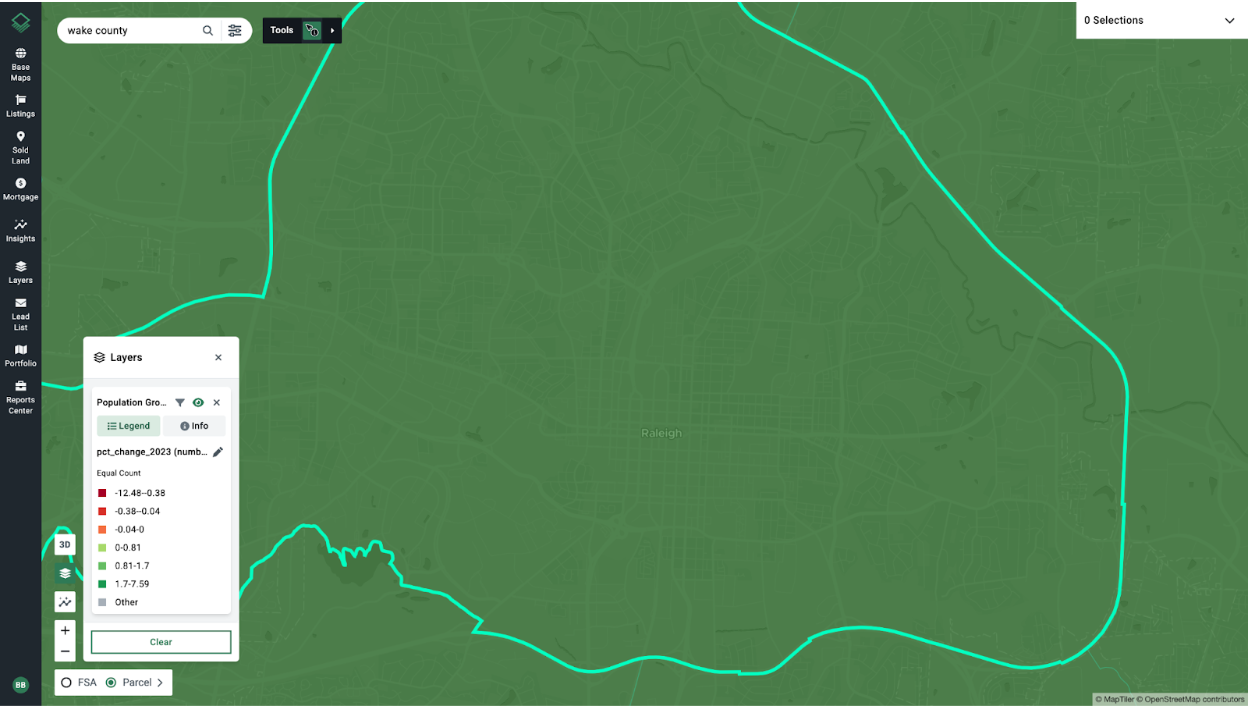

Population Growth: Wake County remains one of the fastest-growing counties in the U.S. With strong net migration and a steady influx of new residents, home builders are using this demographic momentum as a signal to secure land in up-and-coming areas.

Acres’ population layers allow users to view projected growth trends by county, ensuring acquisition strategies are backed by demographic data.

Get Access to Future-State Land Intel

Lagging indicators like permits and closings will only tell you the story after it’s already been written. The Acres Home Builder Index reveals it in real time—showing where builders are betting on Raleigh’s future before it hits the headlines.

See Raleigh’s growth corridors now, not after the market moves. Connect with our team today for access.