With the recent declines in commodity prices for the 2024 crop year and forecasts for lower prices persisting into 2025, two common questions posed throughout the industry are 1.) What is the impact of lower commodity prices on farmland values and 2.) What impact will lower prices have on leases that are being renewed this fall?

To explore the first question, we combined USDA data with farmland transaction data from Acres’ Mid-south Report to examine the historical correlation between regional commodity prices and farmland values for the Mississippi Delta region.

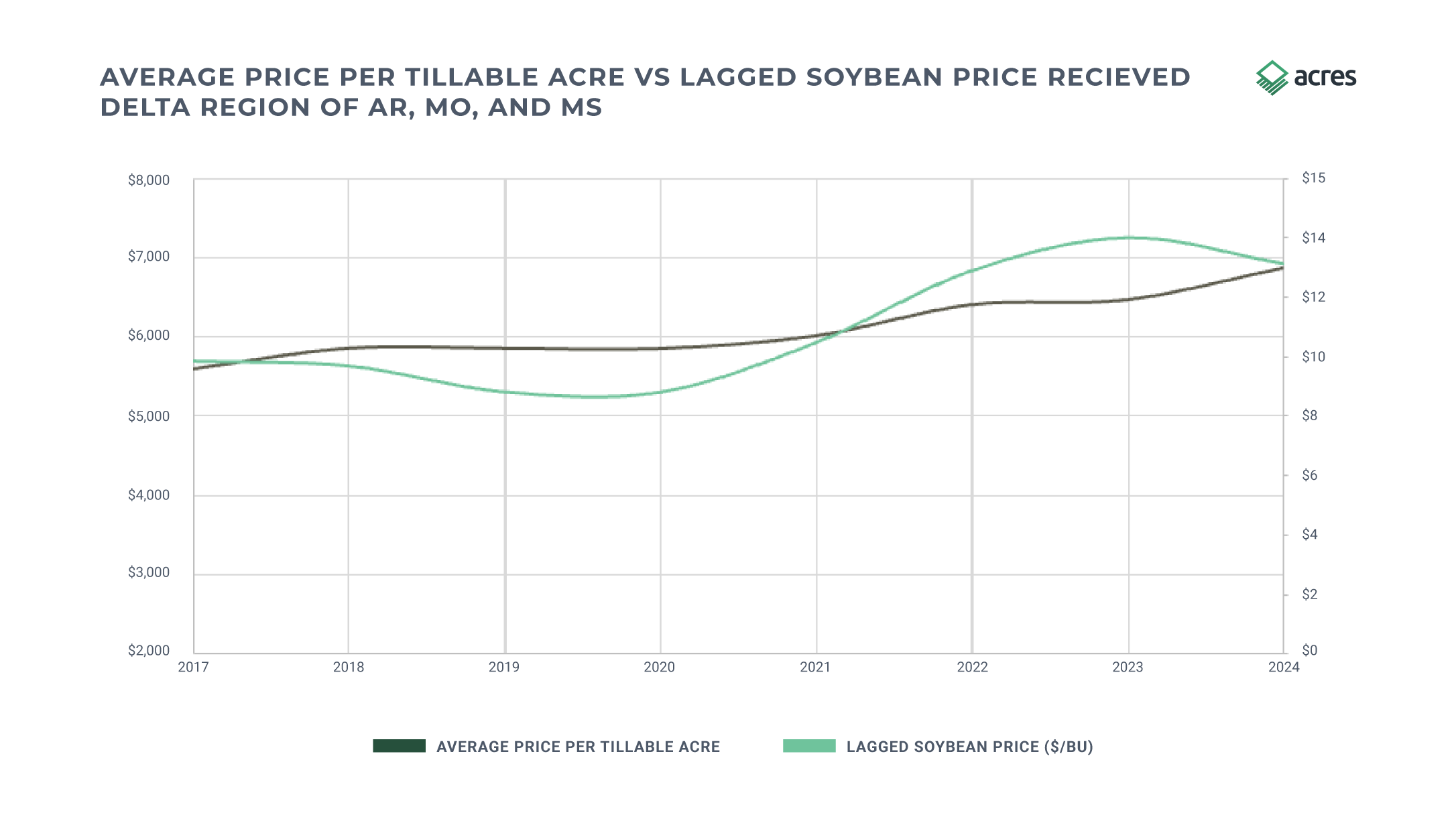

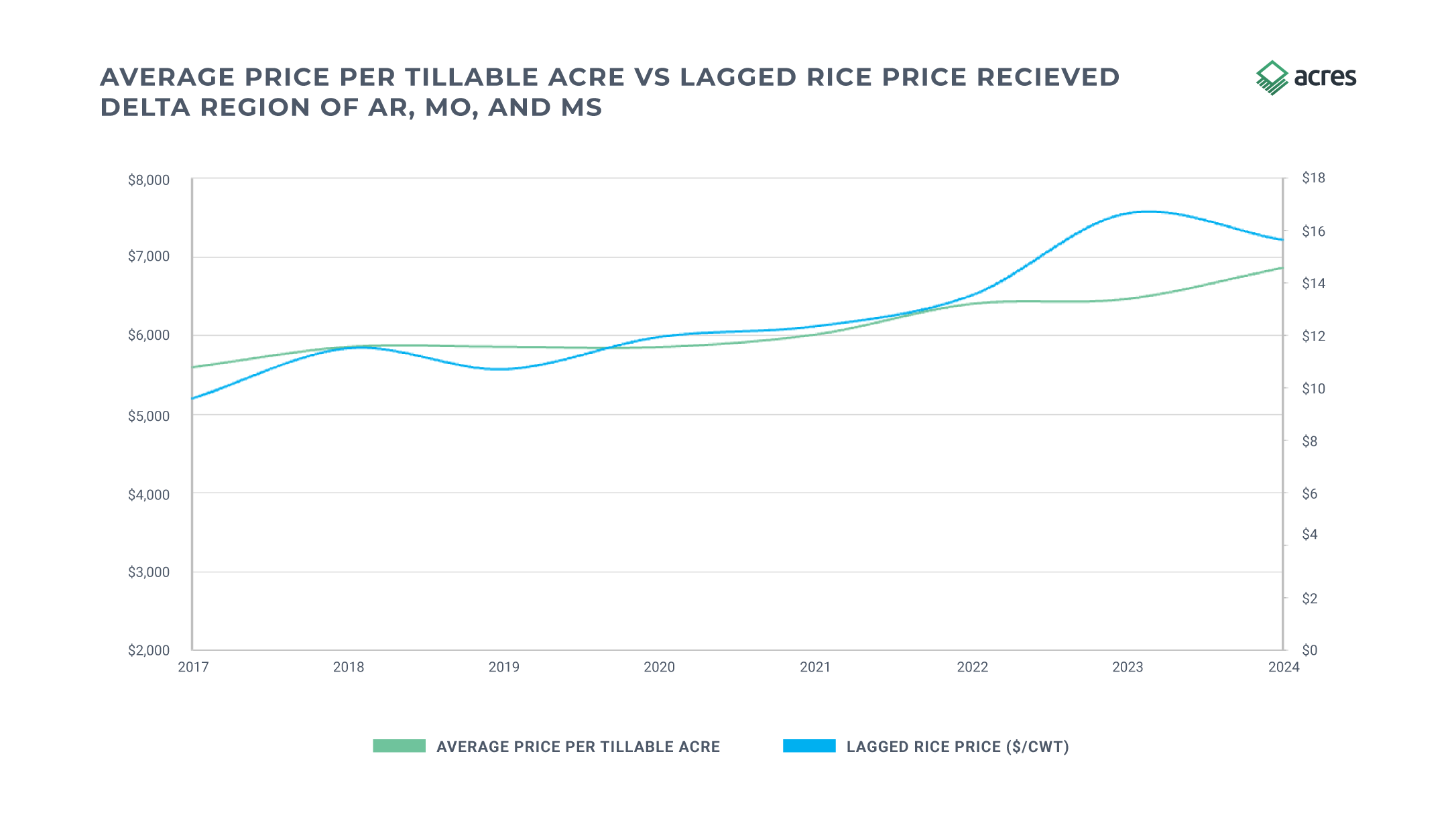

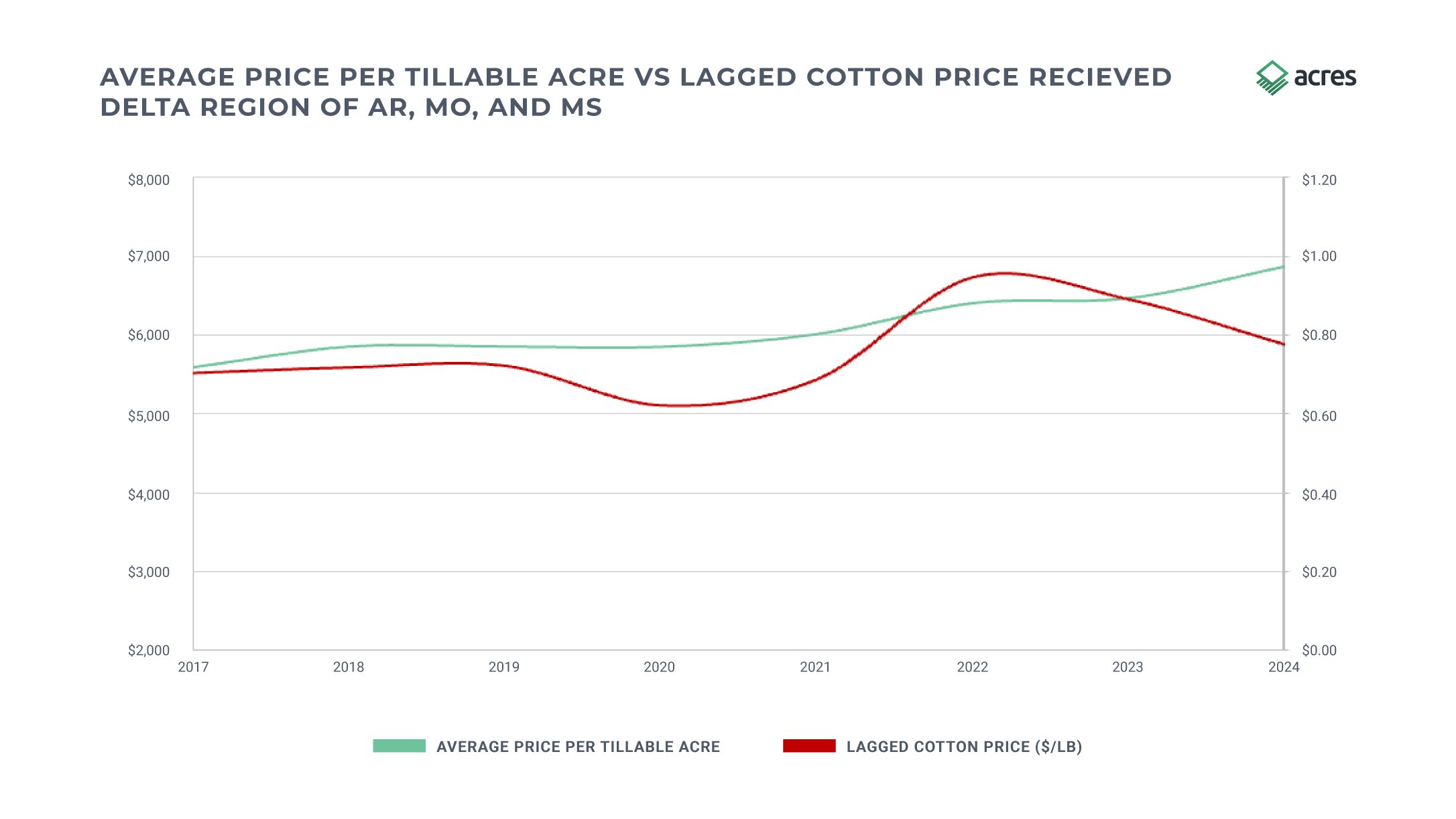

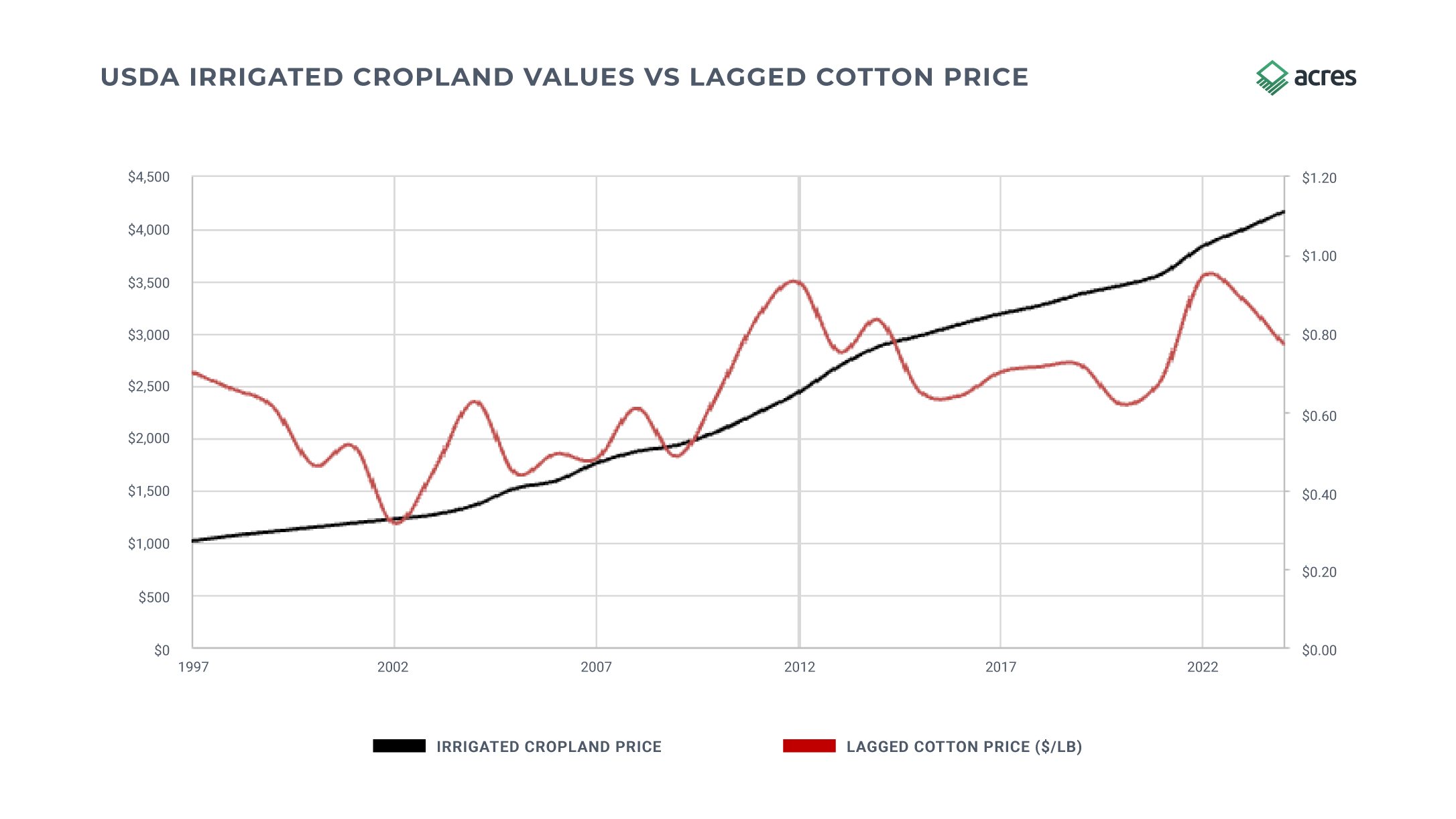

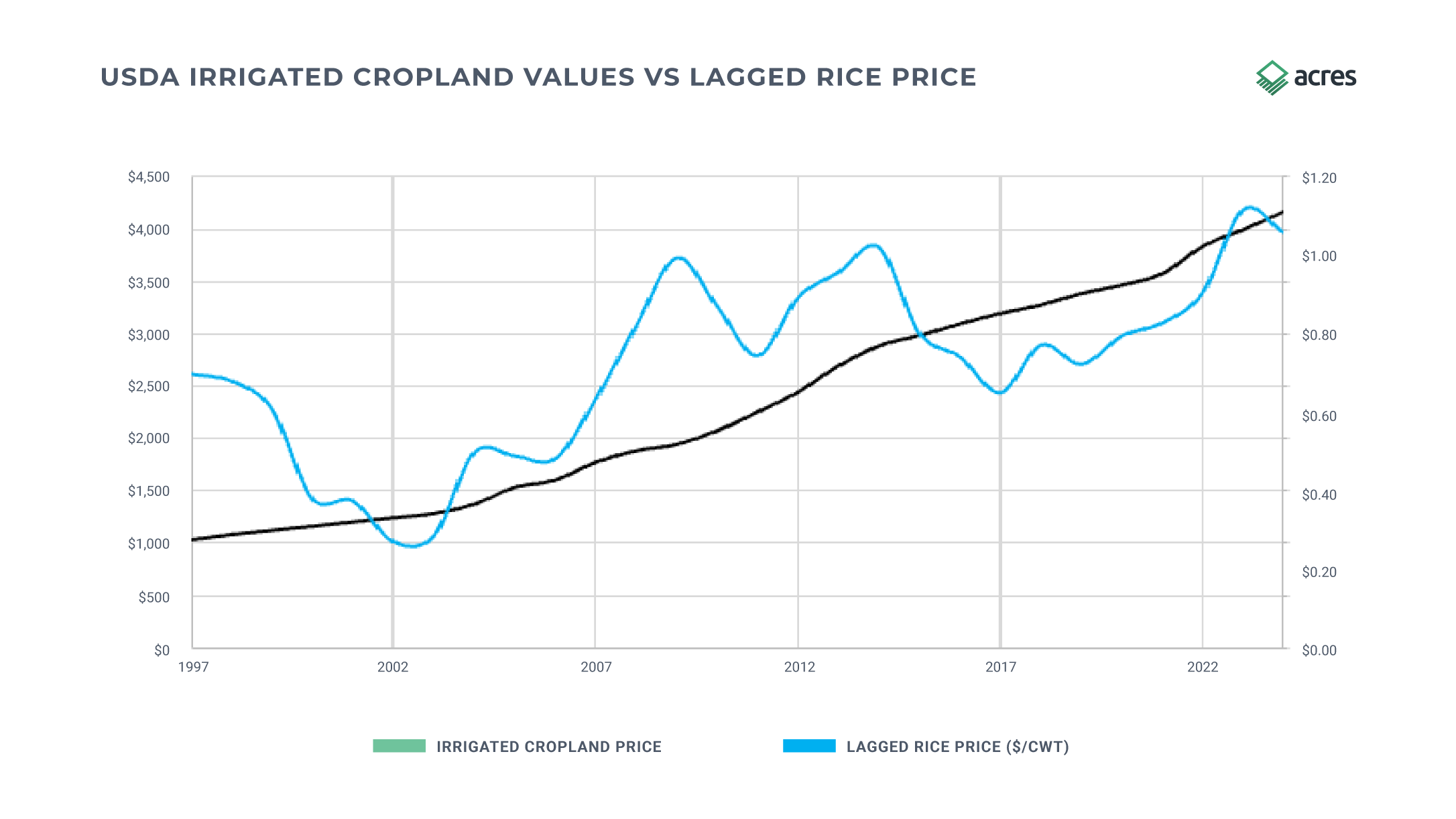

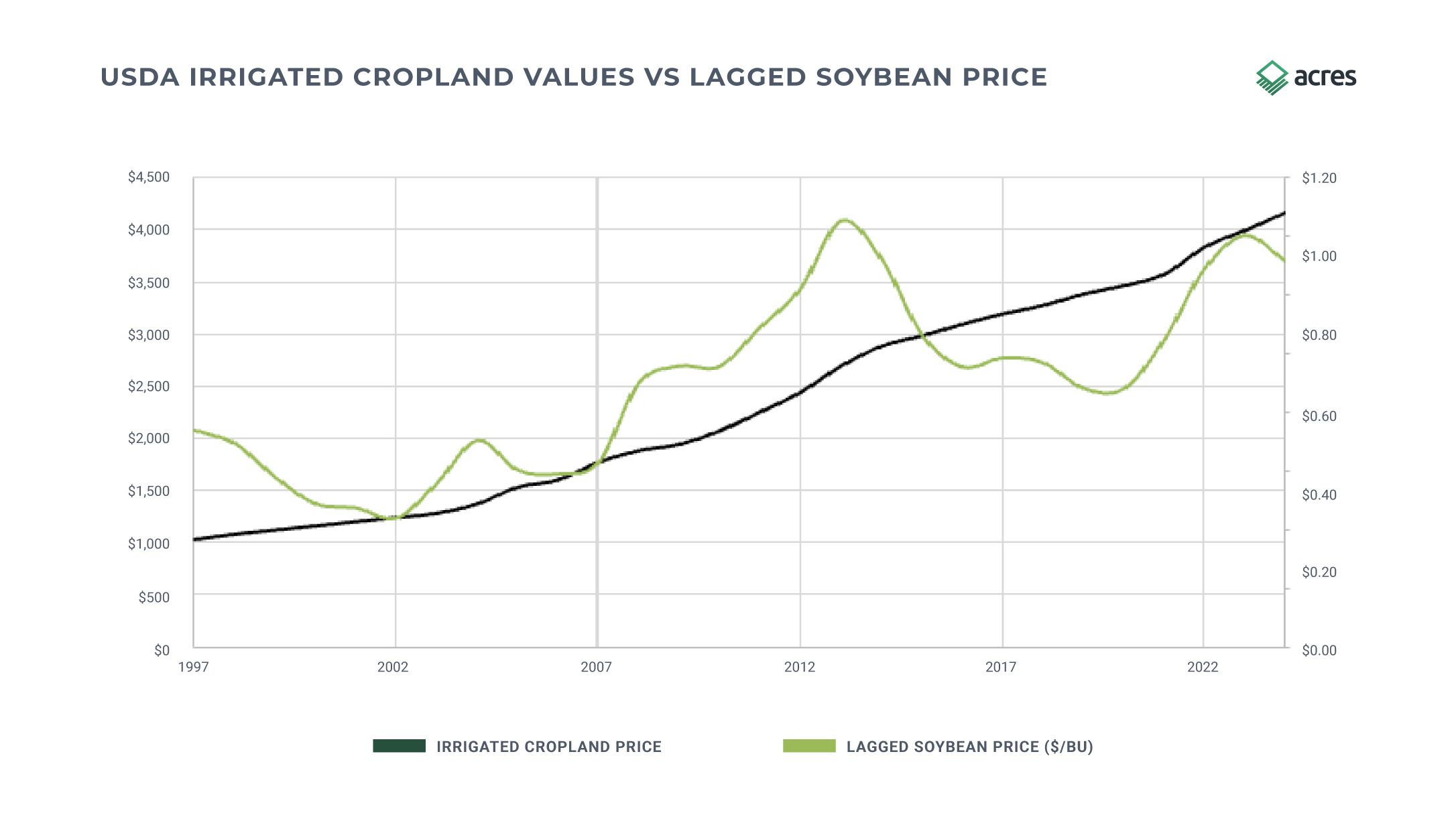

The following analysis used 3,955 farmland transactions from Acres' comparable sales database across the period 2017 - 2024 in the Delta regions of Arkansas, Mississippi, and Missouri. Commodity prices were obtained from the USDA National Agricultural Statistics Service and are the annual regional average price received. Crop prices were lagged one year so that the figures represent the current year’s cropland price relative to last year’s commodity price. Finally USDA survey data on irrigated cropland prices from 1997 - 2024 are examined to encompass a larger time span.

Here are the results.

1. Delta farmland values are historically resilient in the face of commodity price downturns.

The Trend: Significant, multi-year commodity price downturns have been experienced twice in the past 28 years (1997 - 2002, 2015 - 2020) while farmland values have not seen major declines across the same period.

The Takeaway: Delta farmland values have weathered the storm during past commodity price downturns. If the past is indicative of future outcomes, we can expect Delta farmland values to remain resilient through the current commodity price downturn.

2. Periods of lower commodity prices often coincide with slower appreciation in Delta farmland values.

The Trend: Across the recent commodity price decline from 2015 - 2020, Acres data shows Delta farmland values to have appreciated moderately from 2017 to 2019 and then values stagnated until 2021 when commodity prices began to rebound. USDA data exhibits a similar trend of slowing appreciation during the early 2000’s until the commodity price rebound later in the decade.

The Takeaway: While Delta farmland values are resilient during commodity downturns, visual examination of correlations implies that farmland values are not unaffected by downturns in commodity prices.

3. Rice and soybean prices are more strongly correlated with Delta farmland prices than cotton prices

The Trend: When examining the correlation coefficients between Acres Delta farmland values and commodity prices, soybean and rice prices exhibit a correlation coefficient of 0.87 and 0.92 respectively while cotton prices have a correlation coefficient of 0.64. This is mirrored in the longer term USDA data where soybean and rice prices demonstrate correlation coefficients of 0.71 - 0.79 respectively while cotton shows a coefficient of 0.65.

The Takeaway: In the Delta regions of Arkansas, Mississippi, and Missouri; soybean and rice acreage exceeds that of cotton acreage with soybean acreage in Mississippi and Arkansas alone averaging over 5 million acres in the past five years while rice acreage across the region has averaged over 1.6 million acres with cotton acreage averaging over 1.3 million. It comes as no surprise that more widely grown crops have a larger potential impact on the regional farm economy and farmland values.

Final Thoughts

With the recent sharp decline in commodity prices, many land professionals and investors are interested in the potential impact on farmland values. Historical data from the Mississippi Delta region suggest that while farmland values are not immune from commodity price impacts, values have shown resilience even in times of lower commodity prices and uncertainty in the broader farm economy.