For home builders, a single overlooked detail can turn a promising site into a margin squeeze. And while zoning is often the first place teams look, it’s never the whole picture. Real due diligence means stitching together land use designations, overlays, environmental constraints, utility access, infrastructure plans, and more — data that typically lives across dozens of systems, agencies, and PDFs.

Zoning plays a critical role in that puzzle, but it’s rarely straightforward. Requirements can be scattered across municipal documents, embedded in supplemental ordinances, or layered beneath broader land use policies. Those nuances often surface only after capital is committed and teams are deep into diligence.

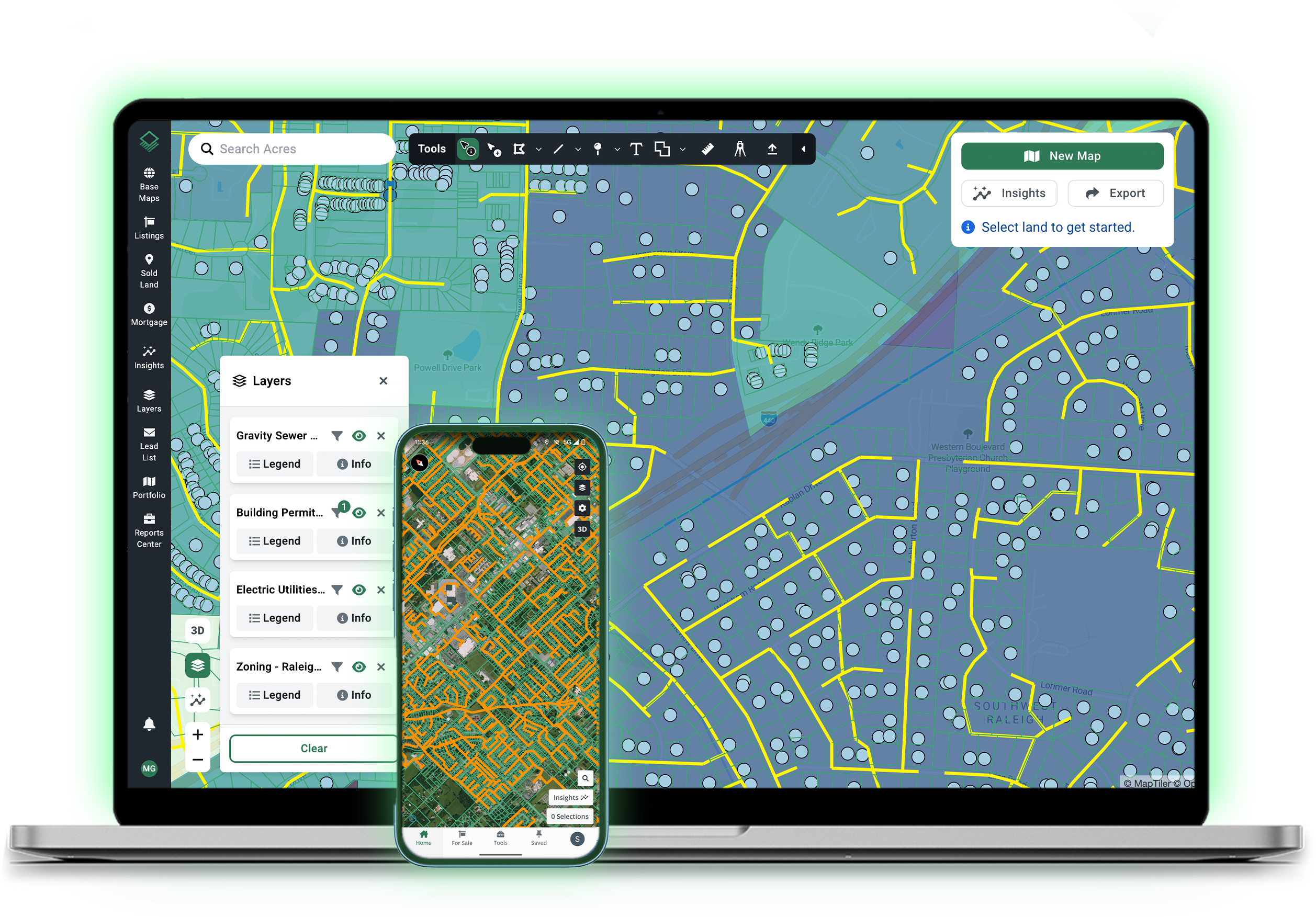

That’s why complete land intelligence matters. Acres.com brings thousands of mapping layers and hundreds of data sources into a single platform (zoning included) so acquisition teams can evaluate sites in context, see how constraints interact, and understand the true buildable potential before moving forward.

In a market where every basis point matters, a fragmented view of the land can quietly erode millions in profit. A comprehensive one can prevent surprises.

Case Study: When One Line of Code Changed the Model

A regional builder identified a prime site for a new master-planned community. Public zoning data showed densities and land-use designations that aligned perfectly with their target yield. But as the team dug deeper across individual municipal documents, they uncovered a buried condition tied to a prior rezoning: an expanded setback requirement that significantly reduced the buildable envelope.

That one line item forced a redesign and cut total lot yield by nearly 15%. What had started as a clean, scalable project now carried thinner margins; along with months of lost time and a sizable diligence bill already sunk. The issue wasn’t the builder’s process. It was the structure of the data itself.

In many markets, zoning information is fragmented across jurisdictions. A county-level layer may cover only part of the market, while critical details—like conditional setbacks, overlays, and supplemental ordinances—sit within separate city or municipal files. Without stitching these sources together, even well-run teams miss constraints that materially change the model.

This fragmentation is what makes complete zoning coverage so powerful. When county-level data is combined with municipal layers (the way Acres unifies thousands of datasets) acquisitions teams can evaluate properties with a level of precision that’s nearly impossible to achieve by bouncing between disparate GIS sites.

The difference is more than convenience. It’s the ability to source confidently, surface deal-killing constraints early, and avoid surprises that only reveal themselves after capital is committed.

The Takeaway: Incomplete Zoning Data = Incomplete Decisions

Builders make multimillion-dollar commitments based on what they believe to be complete, accurate land-use information. But traditional zoning research methods—scattered portals, outdated maps, and manually interpreted PDFs—leave even the most data-driven teams exposed to blind spots.

A single missed overlay or conditional clause can change density, open-space ratios, or buffer requirements enough to shift a project’s entire pro forma.

That’s why more acquisition teams are looking for solutions that bring all the zoning data they need into one place — an advantage that tech-forward teams are already using to stay ahead.

How Acres Helps Builders Catch Zoning Constraints Before They Commit

In competitive markets, the advantage isn’t just knowing whether a single parcel works — it’s finding the right parcels before competitors even know they’re in play. That requires complete zoning and land-use intelligence, stitched together across counties, cities, and municipalities.

Acres brings all of that data into one platform, giving acquisitions teams a sourcing edge long before diligence begins.

With Acres, teams can:

- Search by zoning criteria first, not last. Instead of drawing arbitrary boundaries and checking parcels one by one, teams can start with the zoning codes that fit their strategy and instantly surface the parcels that match.

- Quickly narrow thousands of parcels to a focused, high-quality shortlist. Complete zoning coverage means users can filter for specific codes, convert them into searchable selections, and pinpoint a small number of parcels that meet both current zoning and planned future land use.

- Identify upzoning or entitlement potential in minutes. By overlaying current zoning with future land use, users can spot parcels where long-term plans support residential development; the “needle in the haystack” opportunities that move fast.

- Accelerate sourcing in markets where zoning data is fragmented. Acres eliminates the need to hop between county GIS portals, municipal PDFs, and inconsistent formats, giving teams confidence that they’re seeing every zoning layer available.

Final Thoughts

Every parcel has fine print — but the real advantage comes from seeing the full landscape before you ever zoom in.

With complete, connected zoning intelligence, acquisition teams can flip the search process upside down: using zoning criteria to quickly isolate the few parcels that truly fit their strategy, rather than evaluating properties one at a time and hoping nothing critical is buried in the details.

The result? Faster sourcing, fewer blind spots, and a pipeline built on clarity — where teams spend less time reacting to surprises and more time pursuing opportunities that are aligned from day one.