Land valuation can be tricky. Unlike a house, many factors that determine land prices are less obvious than, say, an in-ground pool or a damaged roof. Still, the process for pricing land follows many of the same best practices.

Agents assign value to land by looking at comparable sales (comps) and conducting a comparative market analysis (CMA). While CMA reports can vary between agents, there are best practices in the field.

By understanding what agents take into account when they decide the value of a property, you can understand why the land you're interested in buying is valued at its current rate.

When valuing land, agents typically look at comparable sales (comps) and conduct a comparative market analysis (CMA). But what do good comps look like and what does CMA report include?

The answer can vary between agents because these reports are not standardized. However, there are best practices, and with a little research, you can understand what goes into a good CMA.

Contents

What are comps?

Can you run your own comps?

What is a comparative market analysis?

What is the difference between a CMA and an appraisal?

How do I get a CMA report?

What does a comparative market analysis include?

What are comps?

Comparable sales, or “comps,” are recently sold properties and current listings that are similar in size, quality, and features to your property.

Comps help both buyers and sellers understand whether a property is priced at market value. This is especially important to understand when it comes to land valuation because there can be vast differences between neighboring properties.

When looking at land comps, examples of features agents may consider include:

- Size

- Location

- Tillable acres

- Elevation

- Soil type

- Crop history

- Flood risk

Because of these nuances, a single comp tells you little. As a rule of thumb, the more comps that can be gathered, the easier it will be to set a fair listing price for your property.

Can you run your own comps?

Running your own comps is possible, but an experienced land agent may be able to help you find comparable sales faster and more accurately.

If you’re running your own comps, pay close attention to details when looking at nearby sales. Soil type, elevation, vegetation, and tillable acres are just a few factors that vary greatly within a short distance. Be patient in your search. Similar properties can take time to find, but it’s a critical step for ensuring you avoid pricing too high or too low.

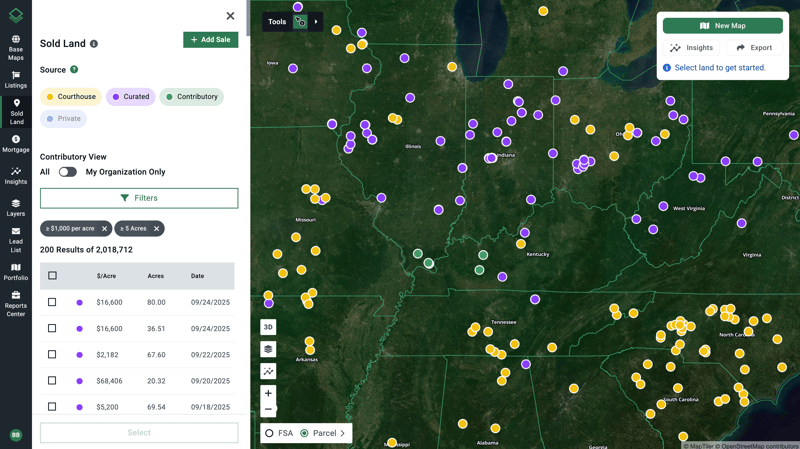

Acres can help you look at recent sales data across the U.S., while providing important details like soil scores and crop history.

What is a comparative market analysis (CMA)?

A comparative market analysis (CMA) is a report that determines the market value of a property. It is typically based on recently sold comps, current listings comps, and micro-market trends.

What is the difference between a CMA and an appraisal?

A CMA is a report provided by a selling agent for free, while an appraisal is a bank process conducted by a state certified or licensed appraiser. An appraisal occurs once a buyer applies for a loan through a bank and requires a neutral third party. In a nutshell, the bank wants to ensure they are not loaning more money than the property is worth.

How do I get a CMA report?

Most agents provide a CMA report for free. While it’s possible to conduct a lot of the same research on your own, a seasoned agent has years of experience evaluating the market and knows how to find reliable sources of information in specific micro-markets.

What does a comparative market analysis include?

A CMA report is not standardized, and the process for how to do a CMA can vary between real estate agents. You can generally expect to find:

- Pertinent data for your property, such as size, soil type, elevation, and other features that impact land valuation.

- Data and information from the original listing for your property when you bought it.

- Information about recent sales comps in your area, including the final sales price, size, and land data.

- Information and data about current listing comps in your area.

- Any micro-market trends that influence your listing price, ranging from nearby development to crop prices.

- A summary of the analysis and pricing recommendation.

Final Thoughts

Understanding how listing prices are calculated can help you choose land with more confidence and ask the right questions when discussing land values with an agent. Still, land valuation is highly nuanced. Using a mapping tool can help you visualize the differences between plots of land and how they might add value to your financial portfolio. Working with an experienced professional can save you time and headaches.

When considering comps and CMA reports, here are a few key points to remember:

- One comp does not provide enough information to value a property. Gather information about as many similar properties as possible.

- Pay close attention to the details. Even neighboring properties can have vast differences that impact price.

- Most real estate agents will provide a CMA free of charge.

- There are no standards for a CMA report, so be aware of best practices ahead of time.

- While a CMA can help you arrive at a listing price, it is not the same as an appraisal.

Working with an experienced agent is the best way to ensure you receive a solid CMA based on similar properties and market conditions. Ready to find your next piece of land? Explore listings and sales data today on Acres.com.