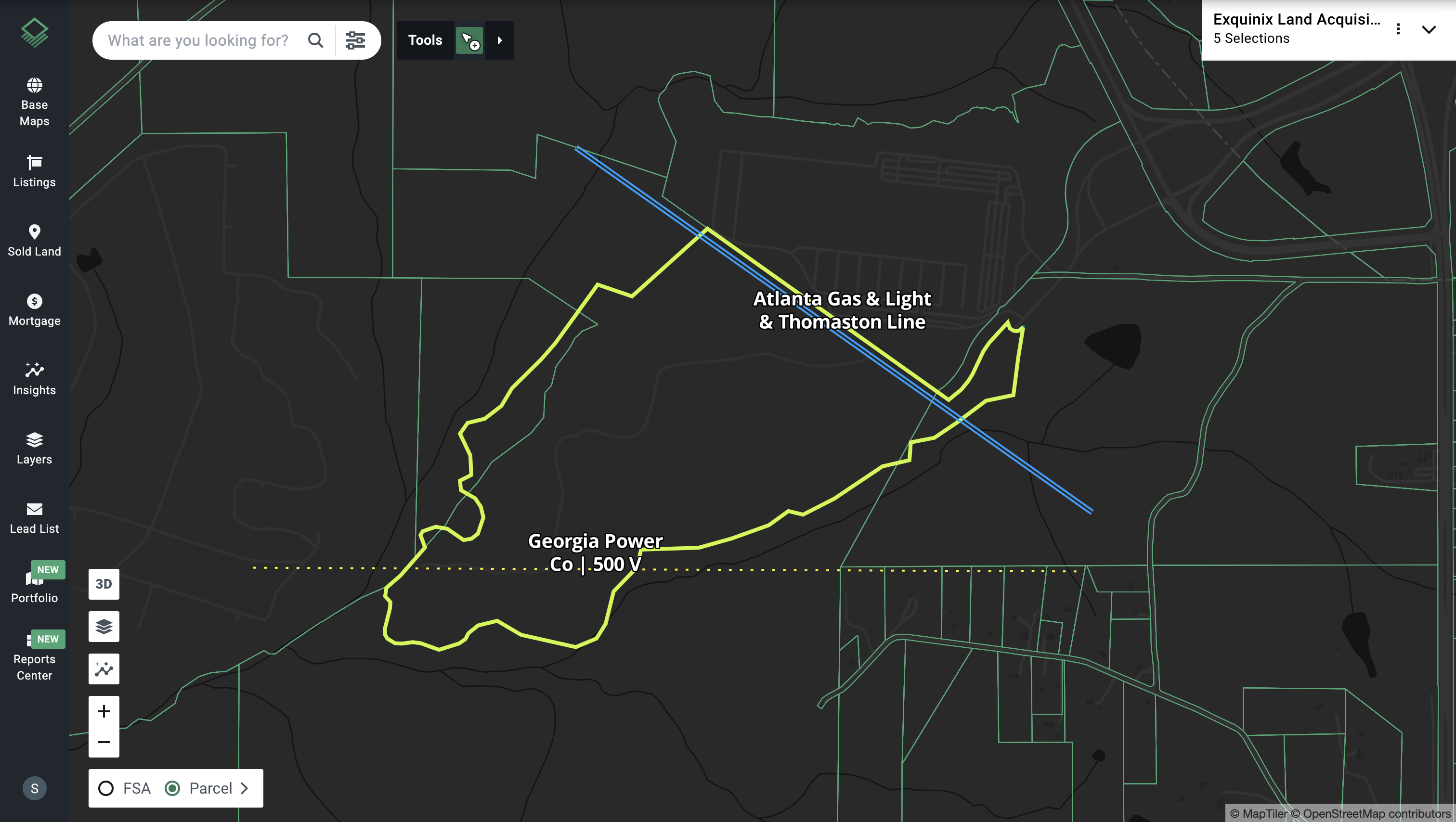

At Acres.com, we surface the land deals and infrastructure signals that shape the future of digital infrastructure. One recently tracked parcel—a 262-acre site south of Atlanta—illustrates how hyperscale developers are adapting to grid constraints by targeting land with built-in power access.

Why It Matters: A Region at Capacity

Atlanta continues to rank among the top U.S. data center markets, driven by hyperscale demand, dense fiber access, and favorable energy pricing. But with record absorption and limited power-ready land remaining, every new development-grade parcel is a competitive advantage.

This 262-acre site is an example of what those strategic land plays look like: infrastructure-adjacent, buildable, and carved out for scalability.

What Makes This Site Strategic

Based on Acres’ land intelligence and transaction insights, several strategic drivers make this location especially compelling for Equinix:

Powering the Future of AI

Equinix’s southern move likely offers access to long-term power pathways via Georgia Power’s transmission infrastructure and existing gas lines. It also creates the potential for on-site energy innovation, including self-generation, which is key for the energy-hungry AI training clusters of tomorrow.

Build-Ready by Design

Our data indicates this site was carved from a larger tract to exclude flood zones, signaling thorough diligence and positioning for streamlined development and permitting.

Room for Phased Expansion

A 262 acre footprint allows for high-density, AI-optimized campus layouts, including advanced cooling, modular scalability, and integrated power planning. It’s a canvas built for what comes next.

Market Validation

South Atlanta is no longer peripheral. QTS has already committed to a 600-acre campus in Fayetteville, and activity across Coweta County and other southern zones confirms booming growth.

What’s the Impact in a Shifting Market?

Equinix’s latest land acquisition reinforces a set of fast-developing trends in the U.S. data center market. The era of large, power-hungry data center campuses is here. AI demands it, but land with power access and capacity is increasingly difficult to find.

- Southern submarkets are the new battleground. Expect competitive land deals and new development announcements from peers aiming to secure their own foothold.

- Power is the gating factor. With Georgia Power forecasting a sizable increase in energy demand, securing access early, like Equinix is doing, is a distinct competitive advantage.

Final Thoughts

Want to uncover emerging development zones, secure power-ready sites, and track competitor activity? Acres.com delivers the complete land intelligence you need to move fast and make confident decisions ahead of the market. Contact our sales team today to learn more.