For home builders, flood maps are a familiar checkpoint in due diligence. If the parcel sits outside the designated floodplain, it’s easy to assume the site is ready for development. But as many teams have learned the hard way, flood zone status doesn’t tell the whole story.

Subsurface conditions—especially drainage—can quietly derail a deal long after the first feasibility reports come back. And when those surprises surface too late, they don’t just slow approvals, they sink the economics entirely.

Case Study: The Deal That Looked Dry on Paper

A regional builder acquired a large tract just outside a growing metro area. The parcel checked all the right boxes: strong demand, favorable topography, and confirmation that it was located outside the FEMA floodplain.

But after months of diligence and preliminary engineering, a new problem emerged. Soil testing revealed extensive areas of poor drainage. To make the site workable, the team would need to add costly mitigation; enough to erase margins and push the project below viability.

By the time the issue surfaced, months of effort and significant due diligence spend were already lost.

The Takeaway: Drainage Data is Deal Data

Flood zones identify risk. But drainage patterns determine buildability. The two aren’t interchangeable, and relying solely on FEMA data leaves a major blind spot.

Even when a site clears all standard checks, undetected soil and drainage conditions can:

- Inflate grading and foundation costs

- Force redesigns and reengineering

- Delay approvals by months

- Kill deals that once looked airtight

Builders who consistently win in competitive markets are the ones catching those red flags first.

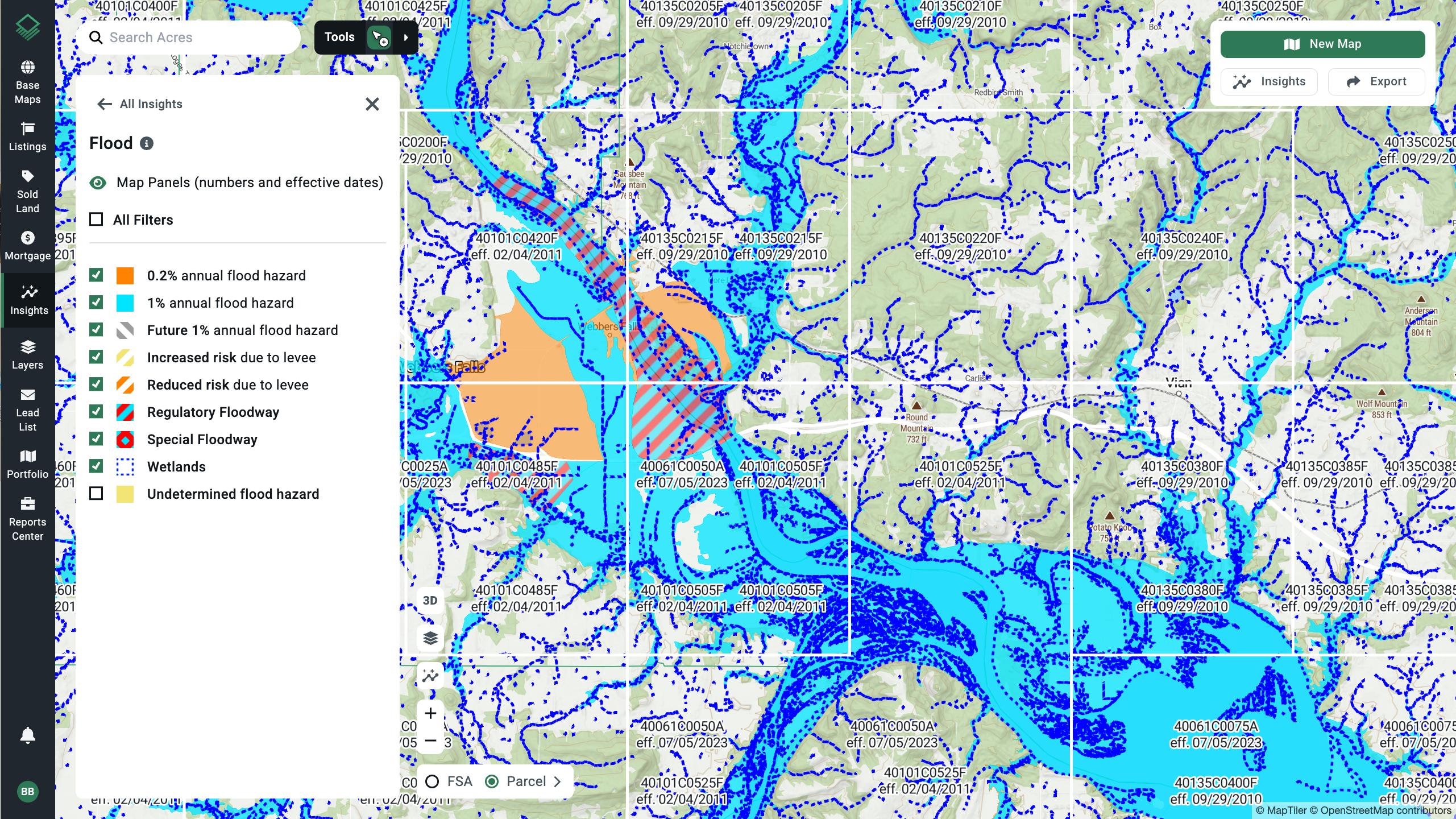

How Acres Helps Teams Catch the Invisible Risks

With Acres, diligence teams can visualize subsurface realities before commissioning expensive studies. Acres’ insights layers—covering factors like drainage, elevation, flood risk, and slope—help acquisition and land teams identify unworkable sites in minutes, not months.

That early visibility changes everything. Instead of tying up capital on parcels that later prove unviable, teams can filter opportunities faster, focus on higher-potential sites, and redirect diligence budgets where they’ll actually move the needle.

For builders balancing aggressive growth goals with tighter margins, that kind of precision isn’t just useful—it’s critical.

Final Thoughts

Good diligence doesn’t stop at the surface. The next competitive edge in land acquisition will come from the ability to integrate deeper environmental and geospatial data into every early-stage review.

Acres makes that possible by surfacing key insights long before costly reports or engineering work begin. The result: stronger decisions, cleaner pipelines, and fewer “surprises” that show up too late to fix.