In residential development, some risks show up in spreadsheets. Others hide in plain sight. School district boundaries fall squarely into the second category.

For most acquisition teams, early underwriting captures the obvious drivers: pricing, comps, velocity, corridor activity, and future growth. But one factor has an outsized (and often underestimated) impact on demand and absorption: Which school district your lots actually fall into.

Families anchor purchasing decisions on school quality, and capital partners model absorption assumptions based on that demand. When those two things misalign, even the strongest dirt can underperform. And that’s exactly what happened in the following case.

Case Study: When a Boundary Line Redefined the Entire Deal

A builder closed on land for a few-hundred–home community in a rapidly growing corridor. Early underwriting assumed steady demand based on nearby sales velocity and demographic trends — the fundamentals appeared sound.

But once presales began, something felt off. Traffic was slower than expected. Conversions lagged. And absorption ultimately ran more than a third slower than the builder had modeled.

The issue wasn’t price, product, or competition. It was the school district line.

Only after closing did the team realize that a majority of the planned lots fell just outside the high-performing school boundary that anchored demand in the area. Families who had shown strong interest shifted back toward competing communities with better-rated districts. The result: a strong site on paper became an uphill climb in practice.

The Bigger Issue: School District Blind Spots Are Easy to Miss

School districts impact more than just marketing position, they shape:

Yet most district boundaries are irregular, non-intuitive, and poorly represented in standard parcel datasets. Builders often rely on county maps, outdated overlay files, or assumptions from nearby comps, all of which can be misleading.

Capital partners, meanwhile, base their deployment decisions on the expectation that demand will behave in line with underwriting. When district lines undermine that assumption, the entire deal is at risk.

How Acres Helps Builders Avoid Demand Surprises

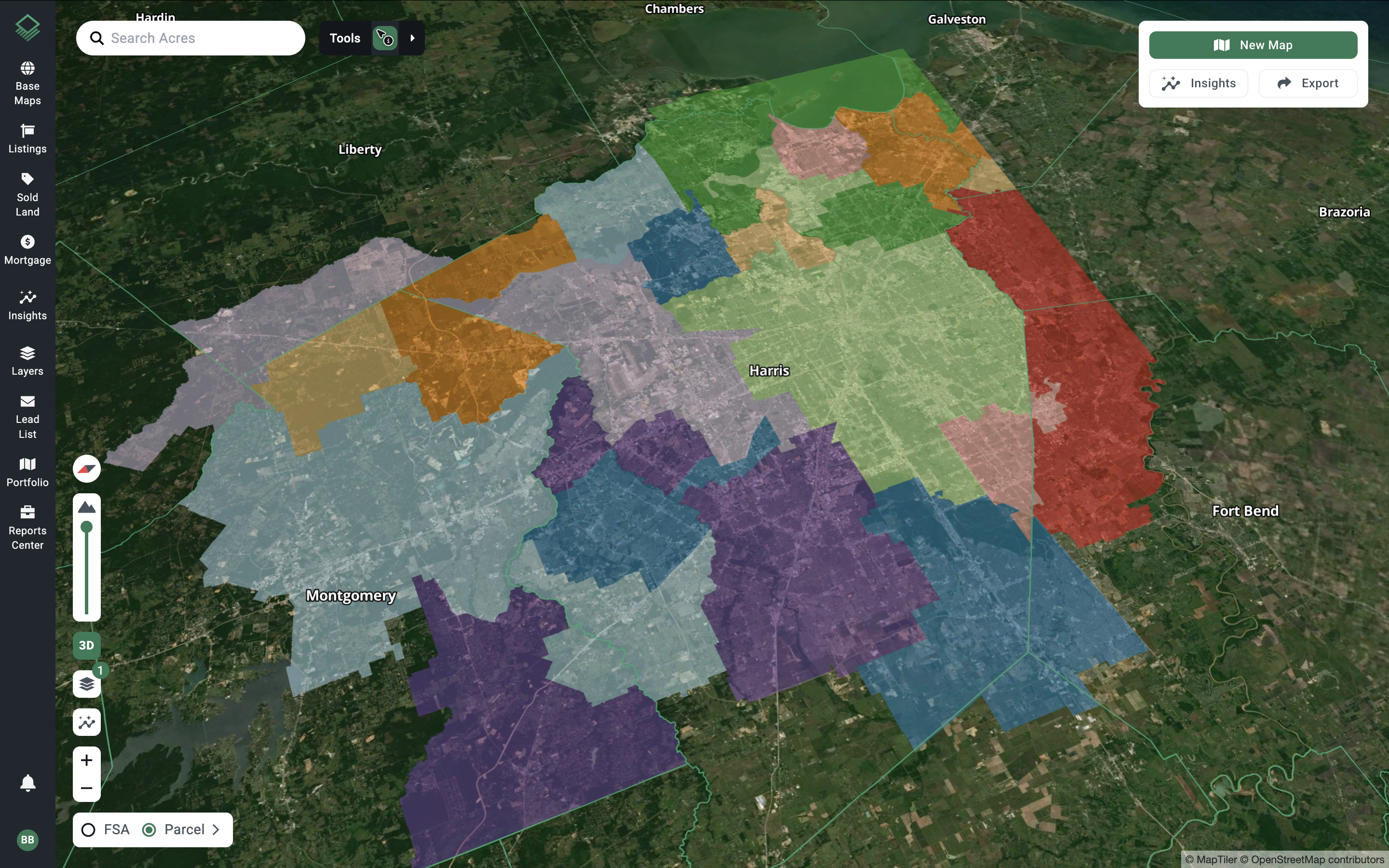

This is where Acres changes the equation. With search filters for school district boundaries, builders and land banks can immediately see how parcel lines map to district lines, before a single dollar is committed.

Acres allows teams to:

For capital partners, this means clearer absorption modeling. For builders, it means avoiding costly surprises — and aligning every acquisition with the demand profile they expect.

In a market where families drive velocity and velocity drives capital, school districts aren’t a detail. They’re a determining factor.