Every edge counts when sourcing land. The faster you can find, qualify, and reach the right decision-maker, the more likely you are to win the deal.

In 2026, leading land acquisition teams are building that edge with AI-powered land intelligence—compressing weeks of research into minutes, filtering for high-value parcels, and engaging owners before competitors even surface the opportunity.

Here’s how they’re doing it.

Contents:

The Opaque Landscape of Modern Land Acquisition

1: Rapid Site Pre-qualification

2: Ownership Mapping and Portfolio Intelligence

3: Leveraging Mortgage Data

4: Integrated Skip Tracing for Direct Outreach

5: Targeted Lead Lists

Building a Stronger Deal Pipeline

The Opaque Landscape of Modern Land Acquisition

The modern land market isn't just competitive, it's opaque. Institutional players are quietly assembling portfolios off-market, often negotiating directly with LLCs and trust structures that never appear in MLS data. By the time a site hits the market, the best opportunities have already been spoken for.

Traditional tools can't keep up. They either lack coverage in niche markets, have outdated data, or fail to provide the full picture, forcing teams to jump between sources to answer basic questions. You're left spending days on parcels that were never viable to begin with.

That's why the best teams have shifted from reactive sourcing—waiting for listings or leads from brokers—to proactive sourcing: identifying strategic sites early, understanding their risks and opportunities instantly, and structuring deals with better data before the competition even knows to look.

1. Rapid Site Pre-qualification

Time wasted underwriting a site that was never viable carries real costs: lost deal velocity, sunk diligence time, and missed opportunities elsewhere. The smartest teams use rapid pre-qualification to quickly eliminate parcels that don’t pencil and concentrate on deals that meet their criteria.

That means asking the right questions upfront:

Is the infrastructure there? Road access, fiber connectivity, and sewer capacity shape what a site can realistically support and how much capital it will require to develop.

What are the environmental risks? A site in a 100-year floodplain may require $400K in mitigation, significantly changing the financial picture of the project.

What are the zoning constraints? Zoning alignment determines whether a project can move forward or requires additional work and delays.

When any of these constraints go unconfirmed early, teams risk investing diligence time in sites that can’t support the intended use, or discovering a critical issue late enough to stall or collapse the deal altogether.

Acres.com lets you layer infrastructure, environmental risk, and zoning intelligence in seconds, helping teams avoid spending diligence time on sites that were never viable to begin with.

2. Ownership Mapping and Portfolio Intelligence

Here’s where many deals stall: a promising parcel is owned by an LLC with no obvious decision-maker behind it. Dig a layer deeper and it’s often tied to additional entities across states or trust structures. Without clear ownership, diligence slows and opportunities slip.

When ownership can be traced back to a parent entity and viewed at the portfolio level, teams gain far more than a name to contact. They can see who else is active nearby, identify competing assemblers, and understand how a parcel fits into a broader ownership strategy.

Portfolio visibility also offers insight into seller motivation. An owner with multiple properties, overlapping assets, or upcoming debt maturities may be more inclined to transact than a long-term holder. Recognizing those signals early allows teams to prioritize outreach, conserve diligence time, and move faster from initial conversation to close.

Acres delivers this visibility through AI-powered asset intelligence, connecting fragmented ownership records across entities and states to surface parent relationships and portfolio context in seconds. Teams aren’t just finding owners, but understanding who they’re negotiating with and how to approach them.

3. Leveraging Mortgage Data

Even the best parcel won't move unless the timing is right.

Here's the pattern: many landowners financed at the bottom of the interest rate cycle, 2016 to 2019, when long-term loans were commonly priced between 3.5% to 4.5%. Those loans are maturing now. When an owner is facing a refinance in a 7% rate environment, holding costs increase and selling starts looking more attractive than rolling into a higher payment.

This is one of the most reliable indicators of seller motivation in land sourcing, yet most teams don’t have clear visibility into it. Instead, they infer intent from listing activity or outreach, even though the strongest signals are sitting in mortgage records.

The smartest teams are filtering for:

- Loan maturity dates

- Interest rates

- Debt origination years

Acres enables teams to surface loan maturity dates, interest rates, and origination timelines directly within the sourcing workflow, so outreach aligns with real financial timing. Instead of building broad lead lists, teams can focus on owners whose mortgage profiles suggest they may be refinancing, restructuring, or evaluating a sale, leading to higher-quality conversations, faster diligence, and deals that move forward because the window is actually open.

4. Integrated Skip Tracing for Direct Outreach

Here's the gap that many teams hit: they've done the work. They've identified the parcel and traced the ownership, but now they're stuck hunting for contact information in six different databases.

The top teams are working with skip tracing directly integrated into Acres’ map interface, surfacing contact data—email addresses, phone numbers, mailing details—without needing to export, cross-reference, or manually validate.

When you can move from parcel identification to outreach in minutes instead of days, you're engaging sellers before they hear from anyone else.

5. Targeted Lead Lists

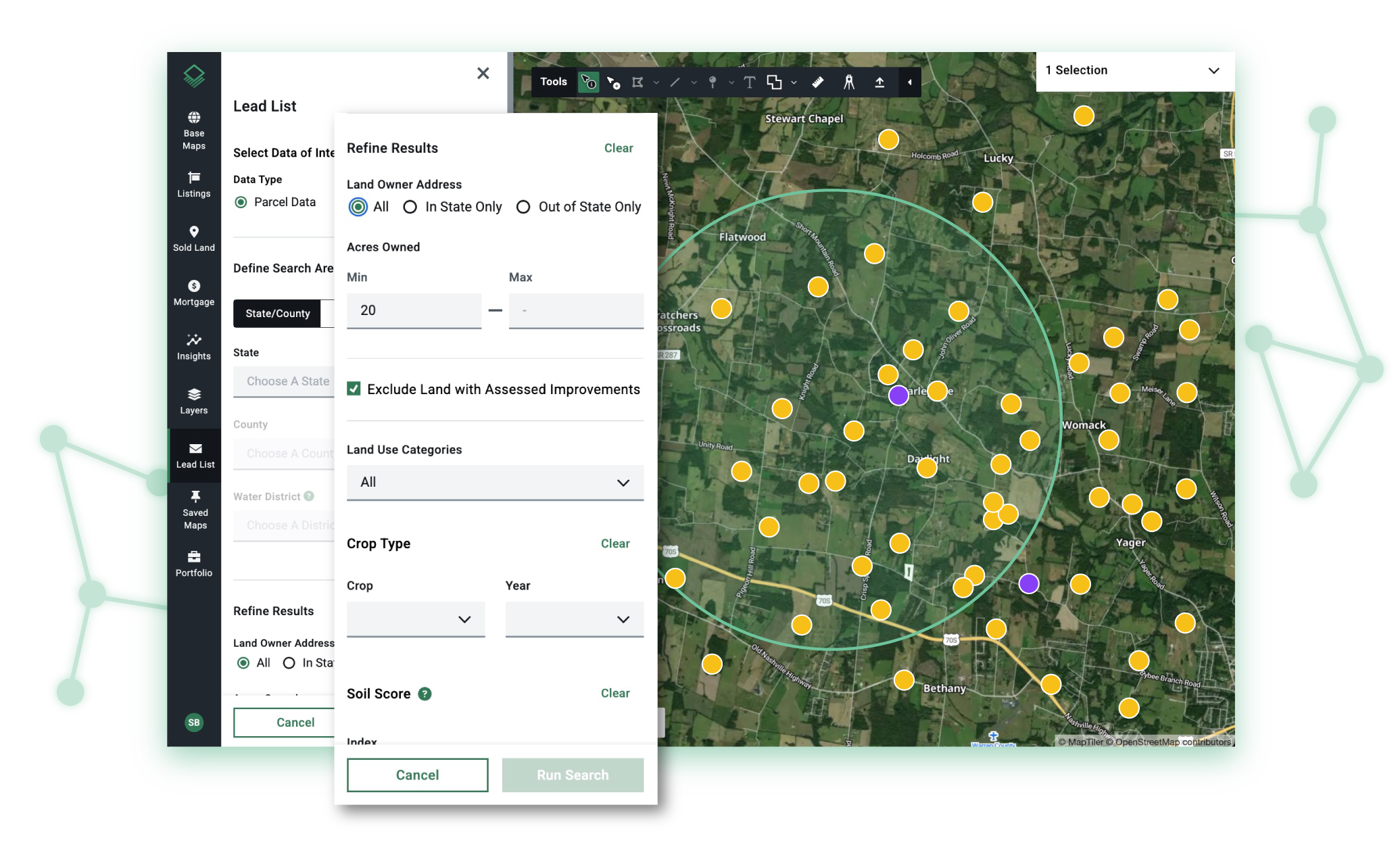

Pulling a list of owner names based on zip codes is like blindly searching for a needle in the haystack. Leading teams use land intelligence to pre-qualify landowners by building targeted lead lists based on highly specific criteria such as such as zoning, proximity to infrastructure, parcel size, absentee ownership, and more. This ensures outreach is directed toward owners whose properties align with the intended use and who are more likely to sell.

With Acres, this process doesn’t have to be slow and manual. Land teams can easily filter for properties within defined areas, like zoning or school districts, and even build lists using mortgage, transaction, or parcel data. It’s a fast way to identify and focus on high quality leads.

Building a Stronger Deal Pipeline With Acres

Complete land intelligence removes blind spots and uncertainty, allowing teams to run a repeatable sourcing system rather than chasing one-off wins. The result isn’t just faster execution, it’s a stronger, more predictable pipeline built on informed decisions at every phase.

Acres unifies every layer of diligence and valuation in one platform, helping teams move deals forward with confidence. Connect with our team today to see how Acres can support a stronger off-market sourcing strategy in 2026.

.png)