What is CUVA?

Georgia’s Conservation Use Value Assessment (CUVA) is a property tax benefit program designed to incentivize landowners to use their land for agriculture, timber production, or environmental conservation.

Under this program, conservation-use property is taxed based on 40% of its current use value instead of 40% of its fair market value—resulting in significantly lower property taxes.

This tax break helps farmers and conservation landowners retain their land without the financial pressure to sell or develop it for residential or commercial purposes.

CUVA Agreement and Penalties

In exchange for this tax benefit, landowners must commit to keeping their property in agricultural or conservation use for 10 years. Breaching the covenant typically results in a penalty equal to twice the tax savings enjoyed to date, plus applicable interest.

How is Current Use Value Determined?

CUVA land values are assessed by trained staff appraisers from the Georgia Property Tax Division in collaboration with:

- The Department of Agriculture

- The Georgia Agricultural Statistical Service

- The Georgia Forestry Commission

- The Department of Natural Resources

- The Cooperative Extension Service

The value of conservation use land is primarily based on how well the soil can support farming (such as growing crops or raising livestock). In other words, the land is assessed based on its agricultural use, not its potential for development.

Role of Tax Assessors

Tax assessors work directly with landowners and are responsible for CUVA administration and compliance, including:

- Approving Applications: Verifying eligibility and required documentation.

- Inspecting Properties: Conducting site visits to ensure compliance.

- Determining Property Value: Assessing land based on its current use.

- Monitoring Compliance: Ensuring adherence to CUVA regulations throughout the 10-year period.

- Enforcing Penalties: Issuing fines for covenant violations.

The Importance of Soil Quality

Soil quality plays a crucial role in land valuation. The U.S. Department of Agriculture (USDA) identifies over 900 soil types, which Georgia’s Revenue Commissioner categorizes into 18 soil productivity classes:

- A1 - A9: Farmland (used for crops and pasture)

- W1 - W9: Timberland (used for growing trees)

Tip: Acres.com’s soil layer provides insights into soil types, productivity index scores, and more—helping landowners nationwide make informed decisions.

CUVA Qualifications and Rules

To qualify for CUVA, a property must meet the following criteria:

- Size Requirement: There is a 10-acre minimum, 2,000-acre maximum. However, properties under 10 acres can qualify if they provide additional records demonstrating conservation use or agricultural income.

- Use Requirement: The land must be used for bona fide agricultural, forestry, or conservation purposes.

- Ownership Requirement:

- U.S. citizen (by birth or naturalization)

- Estates, trusts, or family-owned farms with all owners as U.S. citizens

- Nonprofit recreational clubs or conservation groups

Agricultural and Timberland Property Requirements

At least 50% of the land must be actively used for agriculture or timber production. The remaining 50% may remain undeveloped, but cannot be used for commercial development.

Eligible Uses

- Raising, harvesting, or storing crops

- Feeding, breeding, or managing livestock or poultry

- Forestry, aquaculture, horticulture, floriculture, dairy, livestock, poultry, and apiarian (beekeeping) products

Environmentally Sensitive Property Requirements

Certain environmentally sensitive lands may also qualify for CUVA, including:

- High-elevation landscapes (ridge tops, summits)

- Wetlands and aquifers

- Barrier islands

- Habitats for endangered or threatened species

- River corridors within a 100-year flood zone

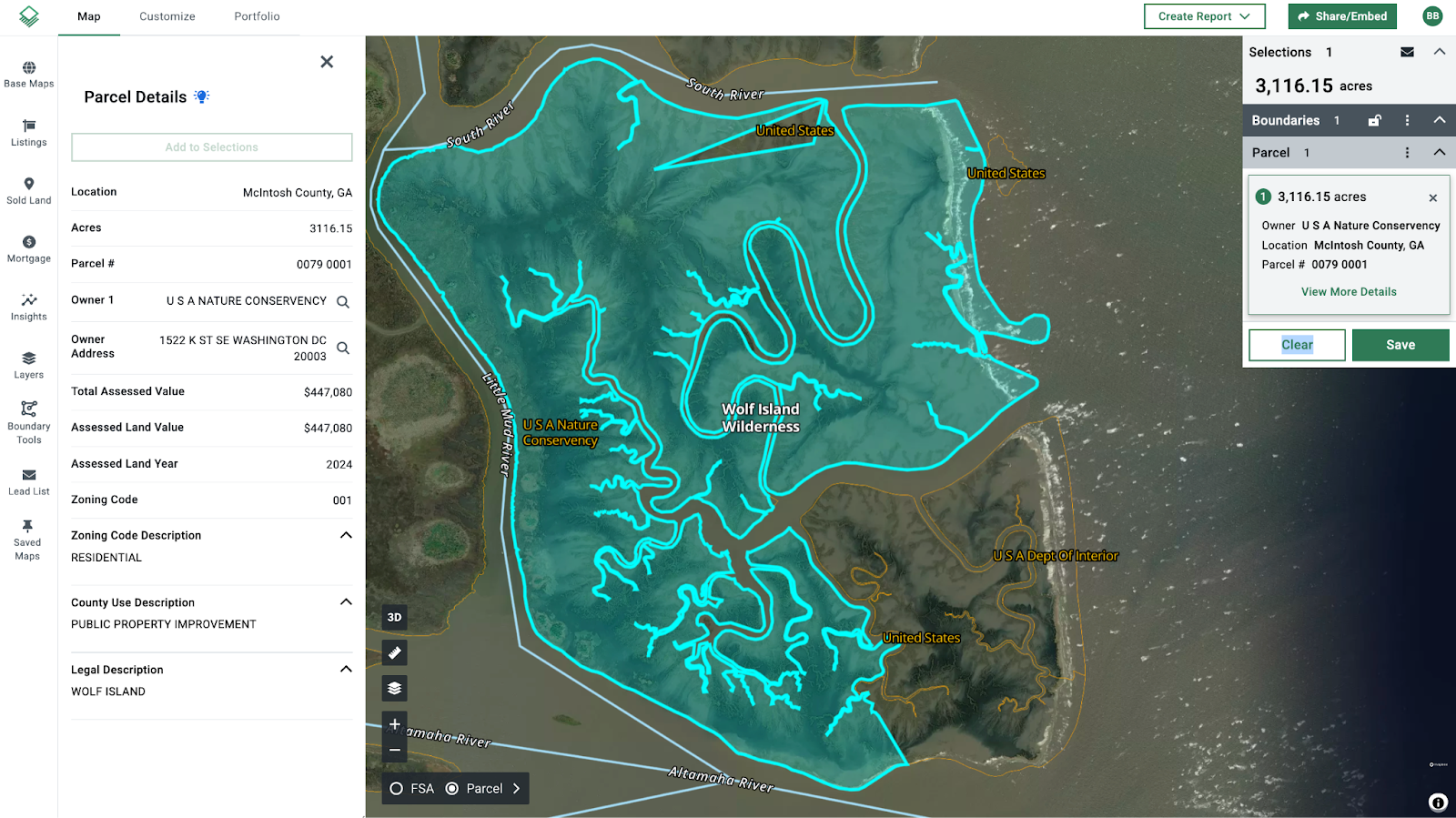

Using Acres to Find Conservation Land

Acres.com offers powerful mapping tools to help landowners and investors identify conservation land.

Parcel Search

- Explore Georgia land with Acres’ interactive maps

- Click on a parcel of interest

- In the top right corner, select "View More Details"

- Check the County Use Description to determine if the land is designated for conservation

Layer Library

Acres’ Layer Library maps gives you the ability to view data within minutes. Our Recreational and Conservation Areas Map allows users to quickly locate protected lands and conservation easements.

FAQs

How Can I Apply For a CUVA Covenant?

If you live in Georgia and plan to use your land for agriculture, timber, or environmental conservation, you can file an application with your county’s tax assessor's office between January 1 and April 1 (or during a county reassessment period).

The application may require:

- CUVA application form

- Proof of ownership (property deed, bills, or other documents)

- Map or photos of the property

- Proof of agricultural/conservation use (such as a management plan)

What Happens if I Buy or Sell CUVA Land?

CUVA covenants run with the land, meaning they stay in effect even if the property is sold or transferred during the 10-year covenant period.

However, new owners must continue conservation use, or they will face tax penalties (up to twice the amount of tax savings received). Buyers should always check for CUVA covenants before purchasing a property.

Can You Build a House on CUVA Land?

With restrictions, you can build on CUVA land. Certain farm structures—such as silos, barns, or homes—may be permitted. However, significant development could violate the covenant, triggering financial penalties.

Always review Georgia's land use regulations before planning construction.

Final Thoughts

Enrolling in CUVA can be a smart financial move for qualifying landowners, but it requires a long-term commitment. Before applying, consider:

- How your land use aligns with CUVA’s guidelines

- Potential tax savings versus restrictions

- Future plans for the property

For landowners and investors seeking conservation land insights, Acres offers data-driven tools to evaluate opportunities, assess soil productivity, and identify conservation properties with confidence.

Sign up today to explore potential opportunities and stay ahead of the market.