Most home builders don’t lose growth because of one bad land deal. They lose it when the pipeline quietly dries up.

On paper, everything can look fine. A few parcels under review. A handful of LOIs out. Broker conversations “in progress.” But beneath the surface, the reality is often harder to see: deals stalled in early diligence, promising sites that never advance, and the future starts resting on assumptions instead of certainty.

Land acquisition isn’t a single decision. It’s a system. And when that system lacks visibility, the risk compounds.

For many teams, land is still managed deal by deal — tracked across spreadsheets, emails, and scattered internal notes. Each parcel lives in isolation. There’s no shared view of what’s early, what’s advancing, what’s at risk, or where gaps are forming two or three years out.

The result is a familiar cycle. Urgency replaces planning. Capital gets reactive. And growth becomes harder to sustain.

The Hidden Risk of Fragmented Land Pipelines

When acquisition teams can’t see their land pipeline as a whole, issues tend to surface quietly and compound over time. Deals linger longer than expected without clear signals on whether they’ll actually close. Leadership grows less confident in forward-looking land positions, while future starts become increasingly dependent on a small number of late-stage parcels. As timelines tighten, teams are forced to scramble for new opportunities, often under pressure and with limited leverage.

None of this shows up in a single underwriting model. But over time, it erodes momentum.

The strongest builders don’t just source land well — they manage it well. They know where every opportunity sits, how it’s progressing, and what it means for future growth. That requires more than tracking parcels. It requires managing a portfolio.

A Portfolio View Changes Everything

High-performing land teams increasingly think of acquisition the way finance teams think about capital: as a pipeline that needs balance, visibility, and foresight.

Instead of asking, “Is this a good deal?” they’re also asking bigger, more strategic questions. How much land do we have at each stage? Where are bottlenecks forming? What does our pipeline support 24 to 36 months from now? And where do we need to be sourcing earlier to stay ahead?

Answering those questions requires more than static reports. It requires a living view of the pipeline—one where teams can flag risks, leave context, and align around what matters most. When insights, assumptions, and next steps are shared directly within the portfolio, teams spend less time chasing updates and more time making informed decisions together.

This shift from reactive deal-making to proactive pipeline management creates a meaningful competitive edge — especially in markets where land is scarce and timelines are long.

How Acres Supports a Pipeline-First Approach

Acres was built to give land teams that portfolio-level clarity.

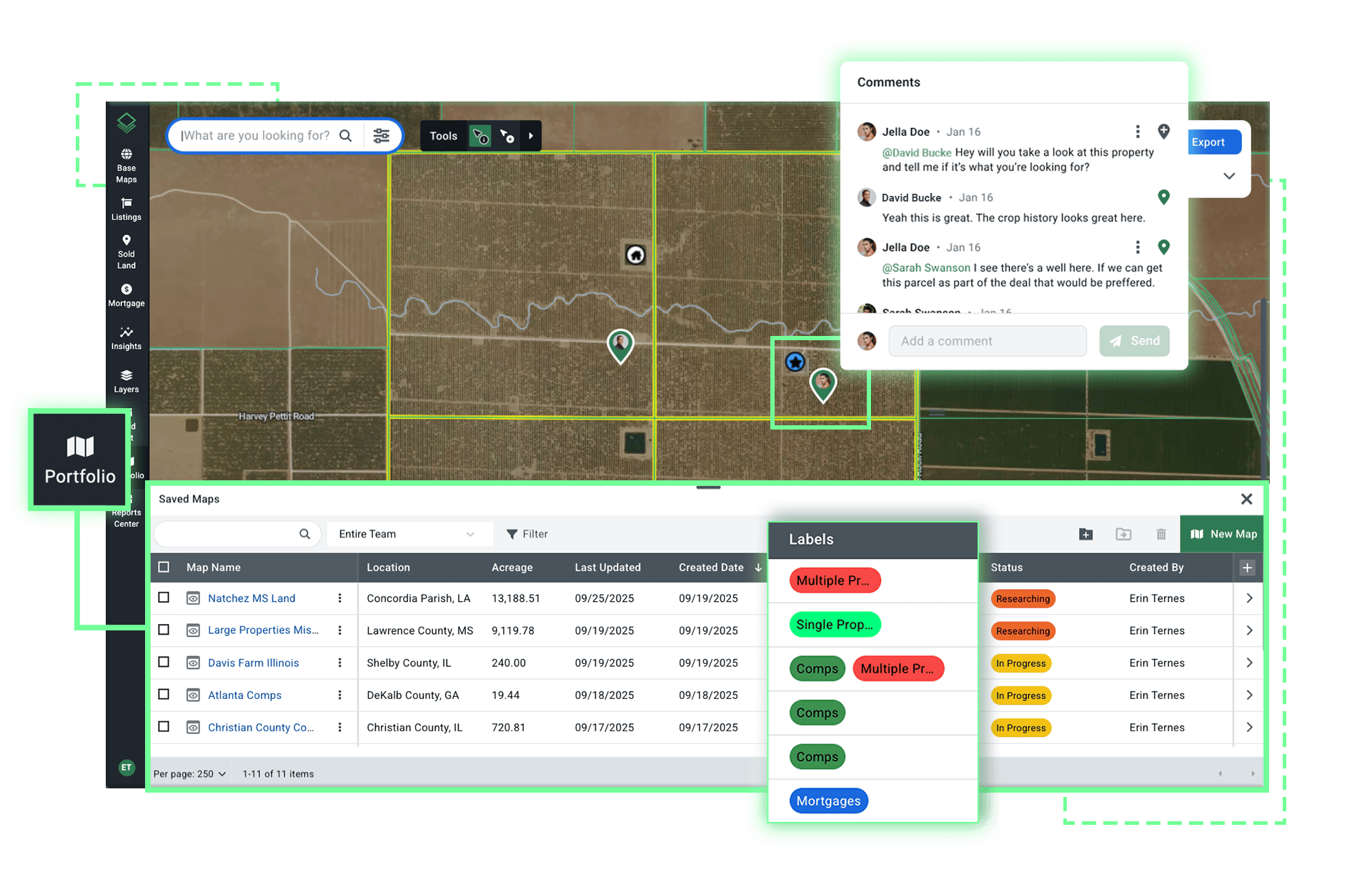

Rather than managing deals across disconnected tools, Acres allows teams to organize opportunities by stage, view activity across markets, and maintain a forward-looking understanding of their land position. Teams can customize their pipeline with columns, labels, and views that reflect how they work—whether that’s tracking entitlement risk, prioritizing school districts, or flagging deals tied to specific growth goals.

With a centralized pipeline view, teams can quickly see where deals stand—from early sourcing through closing—while commenting directly on parcels, tagging teammates, and capturing context that would otherwise live in email threads or side conversations. Stalled opportunities surface sooner. Assumptions are visible. And ownership is clear.

This visibility helps align acquisition activity with start goals and forecast land needs before urgency sets in. Because Acres connects parcels, ownership, zoning, infrastructure, and market context in one platform, the pipeline becomes more than a list of addresses. It becomes a collaborative planning tool that evolves alongside the business.

From Scrambling to Strategizing

When land acquisition is managed as a pipeline, decisions change.

Teams source earlier. Leadership plans with more confidence. Capital deployment becomes more intentional. And growth is supported by shared visibility—not hope.

Instead of wondering whether they’ll have enough land next year, builders can see it. Instead of reacting to shortages, they can anticipate them together, with clarity around what’s progressing, what’s at risk, and what needs attention next.

Land acquisition will always carry risk. But a clear, connected, and collaborative pipeline turns uncertainty into something teams can actually manage.

And in today’s market, that clarity isn’t just helpful — it’s essential.